VISA Stablecoin: The Integration Path of Cryptocurrency and Traditional Finance

Preface

Dogecoin (DOGE) has recently regained the spotlight, with open interest in the futures market reaching $3.4 billion—signaling a significant inflow of investors returning to this prominent meme coin.

Resurgence in Futures Funding Activity

Recent data shows that in just one day, about 14.41 billion DOGE were held in open futures contracts, equating to roughly $3.41 billion. This means a large portion of DOGE is currently represented by open futures positions rather than being held in spot wallets. Some traders view this as a key indicator of strengthening market confidence.

Price and Open Interest Climb Together

Ordinarily, a simultaneous rise in open interest (OI) and price signals that new capital is entering the market. However, the futures trading volume on some exchanges hasn’t surged in tandem, suggesting more investors are choosing to hold their positions and wait rather than trade actively. In these circumstances, a reversal in market sentiment could trigger heightened market volatility.

$0.27: A Key Target

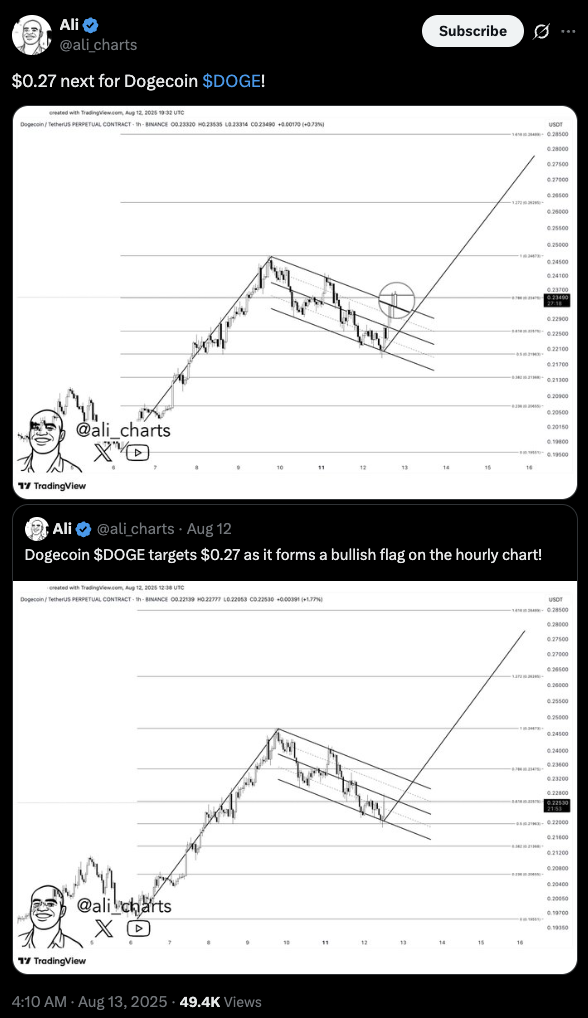

Crypto analyst Ali Martinez shared on X (Twitter) that DOGE is currently forming a bullish flag on the hourly chart, with a technical price target of $0.27. For a confirmed breakout, trading volume must see a clear, substantial increase.

(Source: ali_charts)

Key Indicators to Watch

- Funding rate: Track whether longs continue to pay to hold their positions.

- Futures trading volume: A simultaneous uptick in trading volume and OI provides stronger confirmation of the rally.

- Bitcoin’s trend: Meme coins tend to move in sync with the broader market.

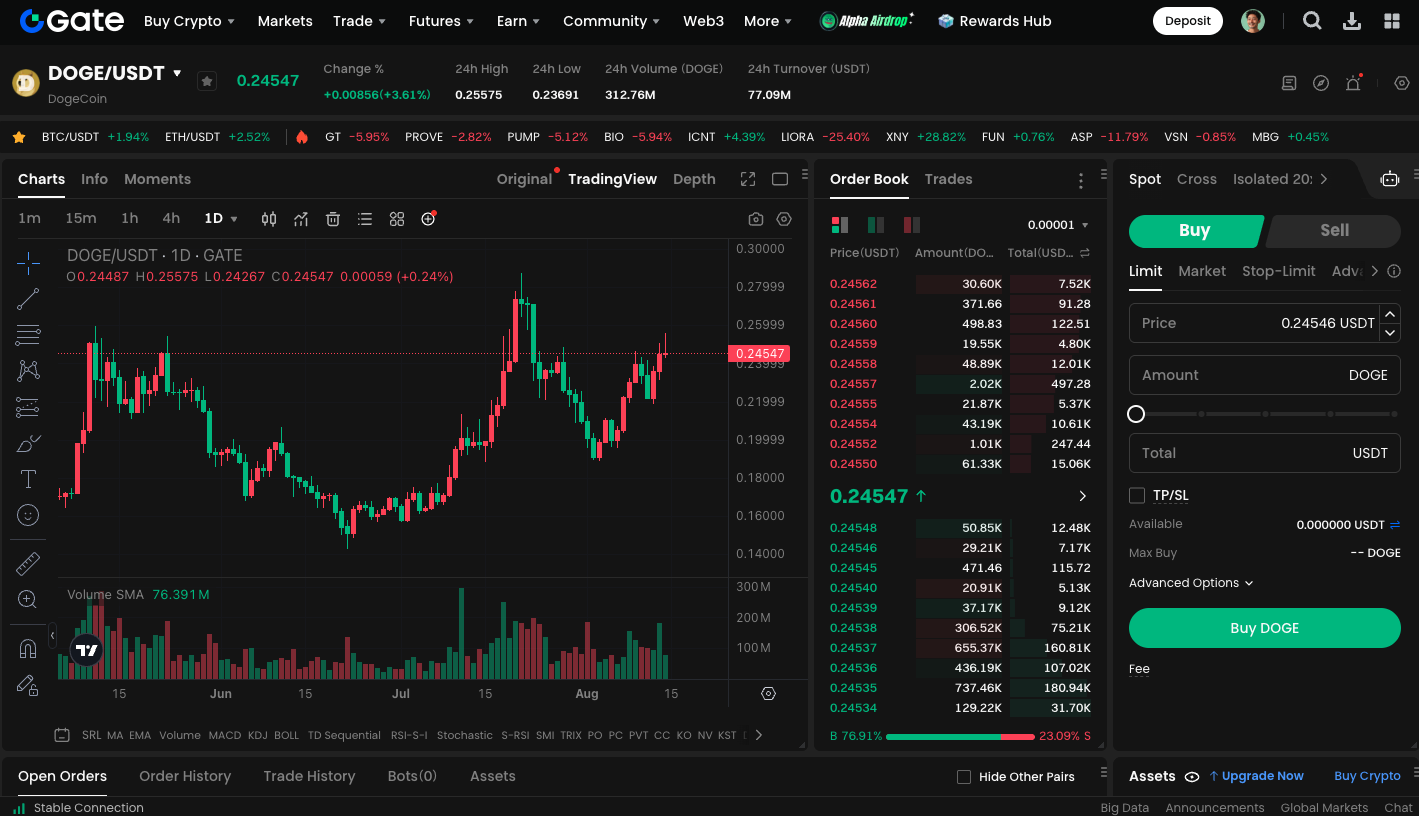

You can trade DOGE spot: https://www.gate.com/trade/DOGE_USDT

Summary

As of press time, DOGE is trading around $0.245. If the price breaks above $0.25 alongside rising trading volume, the market could see another surge. The next target is at the analyst’s projected $0.27 level.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025