One-Click Token Launch Wars Erupt: Meme Launchpad Reshuffle Begins – Industry Status and Endgame Predictions

Forwarding the original title “Hotcoin Research | The War of One-Click Issuing Coin Platforms Begins: The Shuffle of Meme Launchpad Starts, Industry Status and Speculations on the Final Outcome”

1. Introduction

Pump.fun has ignited an unprecedented wave of Meme coin issuance, allowing users to deploy tokens and start trading with a single click without technical skills, triggering a new “coin minting craze.” As a pioneer, Pump.fun has almost monopolized the Meme Launchpad market. Other blockchain networks have also launched their own Meme launchpads, with Tron network’s SunPump experiencing rapid growth under the strong promotion and support of founder Justin Sun; Four.meme has become the Meme launchpad officially supported by Binance, driving the prosperity of Meme on the BNB chain.

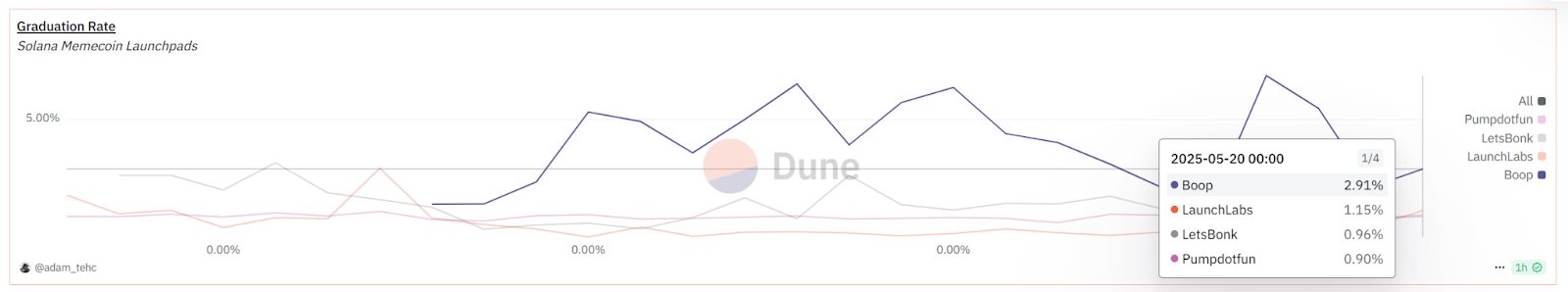

Due to the Pump.fun team’s continuous selling of the earned SOL, it has become the second largest source of selling pressure in the Solana ecosystem after FTX/Alameda. Raydium once derived about 41% of its Swap fee income from the liquidity brought by Pump.fun, but with the launch of PumpSwap by Pump.fun, Raydium’s revenue has significantly decreased. In response, Raydium launched LaunchLab to start direct competition with Pump.fun. Additionally, the on-chain aggregator Jupiter is also trying to launch a similar one-click issue coin service, and the established DEX tool DexScreener’s Moonshot has attracted some players, but the overall effect has not been good. Pump.fun still maintains an absolute advantage in terms of Meme issuance quantity and user transaction volume. However, recently, with renowned NFT collector Dingaling launching Boop.fun, the BONK community launching the LetsBonk.fun launchpad based on LaunchLab, and Believe rebranding its return, the one-click issue coin platform race has entered a competitive phase with multiple contenders. Pump.fun is no longer the only option, and a reshuffling battle around “issue coin rights” has begun.

However, behind the rapid development of one-click issue coin platforms, there are various problems and challenges such as token proliferation, KOL manipulation, frequent Rug Pulls, and regulatory gray areas. How will the war over the “issue coin rights” develop? What direction will the future of the industry take? This article will delve into the current landscape and future trends of the one-click issue coin platform industry, revealing the true logic behind the Meme Launchpad war.

2. Analysis of the Meme Launchpad Mechanism Model

1. The operating model of the Meme Launchpad

The reason why the one-click issue coin platform can attract a large number of users in a short period is that it significantly simplifies the technical process of token issuance. Its operating model can be summarized as: no-code contract deployment + instant liquidity trading, making “anyone can issue coin” possible.

- Contract design and issuance process: These platforms come pre-built with standardized token contract templates and trading pool logic. Users only need to fill in simple information such as token name, symbol, and initial supply, without any programming skills, to automatically deploy the token contract and establish a trading pool with one click. After issuance, the new token will immediately be available for trading in the platform’s AMM pool, without the need for project parties to inject liquidity in advance with their own funds. This no-code, second-level launch process has significantly lowered the technical barrier for ordinary people to issue tokens from ‘requires professional development’ to ‘fill out a form and click a button’, greatly broadening the participation of creators.

- Pricing and Trading Mechanism: Platforms like Pump.fun have pioneered the use of a Bonding Curve model for issuing and pricing tokens. In traditional modes, there are two common methods for new coin issuance: either a presale/IDO, where the project party sets the price and sells a certain proportion of tokens to raise funds; or a free listing, where the market determines the price through matching. However, Pump.fun’s approach is that once a user issues a coin with one click, the platform establishes the relationship between token price and supply based on a preset mathematical curve. Users can mint and purchase tokens by paying SOL or other underlying chain coins to the curve contract, with the price increasing as the purchase volume rises. This model ensures 100% fair issuance: no private placement reserves, no team shares, and the initial batch of tokens and prices are entirely determined by the open market.

- Liquidity Protection Mechanism: Due to the integration with the automated market maker mechanism, the funds from early purchases automatically form the initial liquidity pool of the project, and later buyers take over the sell orders of previous investors, allowing the tokens to be traded instantly on the platform without having to wait for listing on an exchange. All of this enables tokens to rapidly transform from an idea into market-valued assets, greatly satisfying the speculators’ demand for “instant buy and sell”. To prevent common malicious manipulation and exit risks, the one-click issue coin platform has also innovatively designed mechanisms on-chain. Taking Pump.fun as an example, it introduces an LP share destruction mechanism: when the market value of the new coin reaches a specific threshold, such as Pump.fun setting the market value to $69,000, which is the graduation condition, the system will automatically transfer liquidity to mainstream DEXs like Raydium’s liquidity pool and simultaneously destroy the corresponding proportion of LP tokens. This way, the project party cannot withdraw all liquidity and “run away”, which to some extent ensures the trading liquidity safety for early investors. This mechanism technically locks liquidity from being maliciously drained, reducing the probability of traditional Rug Pull.

2. The incentive mechanism of Meme Launchpad

In addition to the basic functions mentioned above, different platforms have also designed various unique incentive mechanisms such as Gas subsidies and reward/profit-sharing mechanisms to attract users and creators.

- Gas subsidy mechanism: In order to reduce the cost of issuing coins and transactions for users, some platforms subsidize a large portion of the on-chain fees, making it almost zero cost for users to issue coins. For example, the one-click coin issuance service SunPump launched on the Tron network supports direct payment of Gas with USDT and subsidizes 90% of the Gas fees, allowing each transaction cost to be lower than 1 USDT. The Clanker platform in the Base ecosystem allows users to create AI Agents and their tokens with zero fees; users only need to on the social platform Farcaster.@ClankerEnter the token name, and the system will automatically generate the token and provide a management page. Throughout the process, users do not need to pay any Gas fees, greatly reducing the participation threshold.

- Reward/Revenue Sharing Mechanism: Launchpads typically receive funding from project parties, with the platform charging a service fee. However, emerging one-click issue coin platforms emphasize community win-win scenarios by returning a portion of the transaction fees to token creators and contributors, forming a creator economy model. Raydium LaunchLab has a service fee of only 1%, of which 25% is used to repurchase its platform coin RAY, and founders can also apply for an additional revenue share of up to 10%. The Believe platform writes 2% of the transaction tax directly into the token contract: each trade incurs a 2% slippage tax, with 1% directly rewarding the token creator, 0.1% rewarded to “Scout” (the earliest user to discover or spread the token), and the remaining 0.9% goes to platform operations, allowing founders and early promoters to continuously earn from token transactions, effectively giving “tips” to creators and evangelists from the community. Pump.fun initially charged a 2% fee on all transactions, which went entirely to the platform, but after observing competition, recently announced that 50% of that would be returned to creators to enhance their motivation.

Through the aforementioned profit-sharing mechanism, the Meme Launchpad has transformed the early “platform wins, users lose” zero-sum structure into a win-win situation for multiple parties, enhancing user stickiness and creator retention.

3. The difference between Meme Launchpad and traditional Launchpad

Meme Launchpad is a one-click issue coin platform, also known as MemePad, which has essential differences from traditional token Launchpads.

- Traditional Launchpad: This refers to traditional blockchain project incubation platforms, such as Binance Launchpad, CoinList, etc., which typically serve projects with a certain level of quality and endorsement. After screening and review, they proceed to public token sales, often involving fundraising, lock-up, KYC, and other processes. The number of projects is limited, and there is an emphasis on success rates and compliance.

- AI Agent Launchpad: Virtuals has launched an AI agent launch platform called Genesis, which uses the $VIRTUAL token for funding to provide startup capital for emerging AI Agent projects. The AI Agent Launchpad is similar to traditional launchpads but focuses on innovative projects related to on-chain AI agents. ai16z launched the auto.fun platform on April 17, aimed at helping users deploy their own AI agents through simple operations.

- Meme Launchpad: The Meme one-click issue coin platform follows an extremely liberal route: zero threshold, zero review, anonymously open, allowing anyone to issue coins for trading at any time. This means that the platform itself does not endorse the quality of the projects, leaving everything to the market’s survival of the fittest. This model aligns with the “trustless” spirit of the crypto world, but it also results in a large number of junk coins and fraud risks, walking a fine line in regulatory gray areas.

In summary, traditional Launchpads resemble a “investment bank + exchange” role, selecting a small number of projects for IPO-style issuance; whereas MemePad is an endless creative testing ground or casino, with a multitude of tokens flourishing simultaneously, featuring both hits and scams.

3. Industry Status: Data Insights and Industry Landscape

1. On-chain data insights: issue coin quantity, user profile and fund flow

Source:https://dune.com/adam_tehc/memecoin-wars

- Coin issuance quantity and trends: The daily issuance quantity of one-click issued tokens on the Solana chain began to climb in mid-2024, peaking in October. At that time, nearly all tokens came from Pump.fun, with a maximum of over 36,000 new coins emerging in a single day. Although the overall issuance volume remained high afterward, it showed a fluctuating downward trend, with a significant cooling evident by early 2025. This indicates that the early stage of rough explosive growth is nearing its end, and the market is beginning to return to rationality. However, even after the fever subsides, one-click issuing still maintains thousands to tens of thousands of new tokens daily, demonstrating the resilience of this platform’s long-tail prosperity.

- User Profile and Distribution: From the user data of various platforms, early users of Pump.fun are mainly speculators from the Solana native community, chasing the myth of hundredfold and thousandfold coins; LaunchLab, backed by Raydium, has attracted many old DeFi users to return, with its daily active users continuously rising after the launch; Believe has attracted many entrepreneurs and KOLs from the Web2 circle due to its characteristic of issuing coins on social media, with a user composition more inclined towards creators and opinion leaders, while Boop.fun revolves around the NFT player community.

- Market value changes of tokens: Observing some typical tokens that have emerged through these platforms, it can be found that most Meme coins have experienced rapid cycles of surges and drops: for example, certain tokens have surged by dozens or even hundreds of times upon launch, but many have returned to zero within a few days. 99% of Meme coins are short-term speculation, with “long-lived coins” being a rare occurrence.

- On-chain Gas and transaction situation: The one-click issue coin craze has also brought significant changes in trading volume and fees to the underlying public chain. Solana experienced frequent network congestion during the meme coin frenzy of 2024-25, which was due to a massive influx of small transactions in a short period, leading to increased block load. At the beginning of 2025, Solana’s weekly fee revenue reached 55 million USD, setting a historical peak. As platforms like Pump.fun slowed down, this figure also dropped sharply, indicating that a considerable portion of Solana’s network activity is driven by meme coin trading.

2. Industry pattern: one strong player and many strong competitors, a hundred flowers blooming.

Source:https://dune.com/adam_tehc/memecoin-wars

According to data from the Dune platform, the market share changes of daily newly issued tokens on the Solana chain show that Pump.fun has long held nearly 100% of the share. Moonshot and SunPump experienced a brief boom in 2024 but gradually fell into silence. After April 2025, competitors quickly emerged, and on May 12, the daily issuance proportion of Pump.fun dropped to about 57%, the lowest. According to the latest data from May 21, Pump.fun’s daily issuance proportion is still as high as 80%, while LetsBonk, Believe, LaunchLab, and Boop occupy the remaining approximately 20% of the market share, presenting a pattern of one strong player with many strong competitors, flourishing in diversity.

- Monopoly has been broken, and competition is fierce: Pump.fun was long the sole leader, but its market share has gradually diluted. New entrants like LetsBonk, LaunchLab, and Believe are starting to carve up the market, with new projects emerging one after another, breaking the monopoly pattern, which is also a sign that the sector is entering a mature phase. Users and creators have more choices, and they will “vote with their feet” to choose platforms that offer higher returns and better experiences.

- The competitive platform reaches a new height: In order to stand out in the competition, various platforms are constantly innovating and creating differentiated features. On one hand, there are innovations in functions and models: for example, some platforms support cross-chain issue coin, some introduce NFT elements to add gameplay to tokens, and some combine oracles to achieve more complex issuance curves, etc. On the other hand, there is competition in incentives: for instance, LaunchLab attracts Pump.fun users with lower fees and creator dividends; Believe lures creative groups with social no-threshold issue coin and Scout incentives; Pump.fun also has to change its aggressive strategy and start offering benefits to creators to prevent user loss.

- Multi-chain layout and ecological competition: The initial craze of one-click coin issuance was concentrated on Solana, but now the multi-chain pattern has become the norm. SunPump has appeared on the Tron chain, Genesis Launches is on Base, and even ecosystems like ICP and Avalanche are starting to experiment with similar projects. Major public chains view these types of platforms as tools to compete for active users and increase on-chain transaction volume—compared to serious DeFi applications, Meme coin issuance is easier to attract newcomers to try, resulting in higher trading frequency and quickly enhancing on-chain activity.

- Narrative and Cultural Competition: The cultural positioning of platforms and community narratives have begun to become competitive soft power. Each platform is establishing its own unique brand image: Pump.fun advocates absolute openness and freedom; Raydium LaunchLab emphasizes fairness and technology; Boop.fun carries personal idol characteristics due to the founder Dingaling’s own IP; Believe emphasizes trust and value, attempting to attract the Builder community. Platform differentiation will not only remain in terms of fees and mechanisms but will extend to the spiritual core and community atmosphere.

IV. Comparison of Mainstream Platforms and Case Analysis

With the rise in popularity of the Meme and AI Agent concepts, various one-click issue coin platforms have emerged, creating a situation where one is dominant and many are strong. Currently, there are several major players in the one-click issue coin field, including: Pump.fun, Raydium LaunchLab, LetsBonk.fun, Believe, Boop.fun.

1. Pump.fun

As a pioneering platform, Pump.fun has created a paradigm of one-click issue coin + binding curve, attracting a massive user base with Solana’s low transaction fees. Its main features include zero threshold and no review, allowing anyone to instantly issue coin and trade. Pump.fun uses an internal “internal market” and “external market” two-phase model: new coins first trade in the AMM pool within the platform, and once the market cap reaches about $69,000, they graduate to external DEX, initially using Raydium, later switching to its own PumpSwap. The platform charges a 2% transaction fee. To prevent exit scams, Pump.fun ensures liquidity safety through LP locking and burning mechanisms.

Pump.fun dominated the market in 2024, contributing over 98% of the daily issued coin share. On the peak day of October 24, 2024, the number of coins created in a single day exceeded 36,000, with an average of 25 new coins born every minute. Such an exaggerated “production rate” of coins led to Solana being jokingly referred to as the largest “casino” on-chain. However, beneath the surface of Pump.fun’s success lies a heavy concern: the majority of the projects that surged are of questionable quality, with a graduation rate of less than 1%. The vast majority of coins are fleeting and quickly go to zero. The phenomenon of the platform making money while users lose money is particularly prominent.

2.LaunchLab

LaunchLab is a one-click issue coin platform launched by the well-established Solana DEX Raydium in March 2025. Raydium previously derived about 41% of its Swap fee revenue from the liquidity brought in by Pump.fun. With the introduction of PumpSwap, Raydium’s earnings significantly decreased. Therefore, the launch of LaunchLab is seen as Raydium’s counterattack. The overall model of LaunchLab is highly similar to Pump.fun, also featuring one-click issue coin on the DApp page + curve pricing + AMM trading, but with targeted optimizations in some details.

- More pricing curves: Supports various curve models such as linear, exponential, logarithmic, etc. The project party can choose according to the nature of the coin, making it more flexible.

- Lower fees: The transaction fee is only 1%, which is half of Pump.fun’s; and there are no additional migration fees. However, migrating Pump.fun’s graduation coin to Raydium incurs a listing fee of 6 SOL.

- Lowering the graduation threshold: requiring the raising of 85 SOL (approximately $11,000) to transfer into the Raydium external trading pool, which is easier to achieve compared to the fixed market value threshold of Pump.fun, and LaunchLab supports a minimum launch mode of 30 SOL, further reducing the threshold.

- Creator Revenue Share: Introduce a 10% fee-sharing mechanism, allowing project founders to continue receiving 10% of the transaction fees of their tokens after graduation, enhancing creator retention.

- Ecosystem Integration: 25% of the transaction fees will be used to buy back the Raydium platform coin RAY, and support functions such as LP staking and diverse pricing, binding platform incentives with the Raydium ecosystem.

The advantage of LaunchLab lies in its reliance on the Raydium brand and the depth of its liquidity pool, successfully attracting a number of projects to switch to its platform, thus weakening the dominance of Pump.fun. According to on-chain data, LaunchLab’s daily active users are growing rapidly, and there are currently 14 coin issuance platforms based on LaunchLab, accounting for about 10% of the daily token issuance volume on the Solana network.

Source:https://raydium.io/launchpad/

3.LetsBonk.fun

LetsBonk.fun is a one-click issue coin platform built on the technical framework of Raydium LaunchLab by the popular meme coin BONK community on Solana, specifically serving the issue coin needs of the BONK community and its derivative creations. The issue coin process and rules for users on LetsBonk.fun are similar to those of LaunchLab, such as the default graduation of 85 SOL and a 1% fee, but the entry interface and community orientation are more in line with the Bonk style.

LetsBonk.fun made a significant impact when it was launched, successfully capturing about 17-20% of the daily issuance share at one point, and even surpassing Pump.fun in certain periods to become the platform with the highest number of daily graduated tokens. This is seen as a victory of community power against giants: Bonk, as a Meme coin that spontaneously rose from the Solana community, built its own Launchpad leveraging its appeal, thereby forming a “wolf pack strategy” to attack Pump.fun.

The popularity of LetsBonk.fun shows the value of well-known Meme coin IP in platform competition, bringing its own traffic and user base, ensuring that the platform starts with attention. However, its sustainability remains to be seen; for now, it seems more like a part of the auxiliary LaunchLab strategy.

4.Believe

The founder of Believe is Australian young entrepreneur Ben Pasternak. The platform was originally a social token application called Clout. Clout fell silent due to over-reliance on celebrity endorsements, but Ben made a comeback at the end of April 2025 with an upgraded version of Believe, changing the slogan from “Believe in Someone” to “Believe in Something,” no longer promoting celebrities, but instead looking for meaningful creative projects.

In terms of issuance method, Believe adopts an innovative interaction by using social platforms as the entry point for issuing coins. Users do not need to log in to any DApp, just give their account on the X platform.@launchcoinPost on Twitter with the desired token name, and the Believe system will automatically detect the instruction, invoking the on-chain contract to create the token using the Meteora platform’s joint curve model.

Source:https://x.com/launchcoin/

Believe has also introduced a “B-point” mechanism similar to crowdfunding: after each token is issued, the total accumulated transaction fees will be counted, and if it reaches a certain threshold (B-point) set by the platform, the token founder can withdraw these funds to fulfill their project Roadmap; if the target is not met, it is regarded as market disapproval, and the funds remain in the pool or belong to the platform. This logic is similar to Kickstarter’s all-or-nothing crowdfunding, but the B-point is not a fixed value, rather it is dynamically determined based on the project’s situation, with the core idea being “trading enthusiasm is market voting.” In terms of revenue distribution, half of the 2% tax on each transaction is returned to the creators (1%) and Scouts (0.1%). This way, founders and early evangelists who help spread the project can also share profits, encouraging community participation in discovering quality content. According to statistics, since its launch, the Believe platform has recorded a total transaction amount of $1.8 billion, bringing approximately $9.5 million in direct income to various token creators.

The Believe platform has faced some controversies. The token LaunchCoin, issued by founder Ben himself, skyrocketed 200 times on the day it was launched. Subsequently, Ben sold off most of his LaunchCoin in batches, making a profit of about $1.3 million, which raised community questions about whether the “founder exploited trust for arbitrage.” Additionally, in the early stages of Believe’s issuance, in order to prevent selling pressure, a high slippage tax was set on token transactions, resulting in blockchain bots taking advantage of this high tax period to acquire tokens at low prices, and then massively selling them off after the tax rate decreased over time, causing many token prices to crash rapidly after reaching market valuations of tens of millions. Some in the community joked, “The founder, Scout, and the platform are all fine, but the retail investors who took over are really hurt.”

5.Boop.fun

Boop.fun is an issue coin platform on the Solana chain launched by well-known NFT collector Dingaling, featuring a strong personal brand color. Its model is similar to Pump.fun, also utilizing a bonding curve + Raydium LP scheme, but adds some proprietary token economics: for instance, each new coin issued through Boop.fun will deduct a “developer tax” of 5% to distribute to holders of the Boop native token, reflecting the platform’s intention to create a value-returning ecosystem for its own tokens.

Due to the influence of Dingaling in the community, Boop.fun attracted a group of loyal fans after its launch, but its overall scale is relatively smaller compared to the aforementioned platforms. Currently, its daily issuance accounts for about 1-2%, with a graduation rate slightly higher than Pump.fun.

Source:https://dune.com/adam_tehc/memecoin-wars

The differentiation of Boop.fun lies in its small but beautifully managed community operation. Dingaling backs the platform with personal credibility, bringing users together through the $BOOP token. However, this also means its scalability is limited, playing more of a role in niche markets.

5. Issues and Challenges: Concerns Behind Prosperity

The one-click issue coin platform makes “fast coin creation” a reality, but also amplifies the speculation and fraud risks in the crypto market. The extremely low threshold is an invisible hand: it invigorates the market while allowing bubbles to grow unchecked.

- The extremely low threshold has led to an overflow of on-chain garbage: anyone can issue coins, which means a large number of worthless air coins flood the market. Less than 1% of tokens can successfully “graduate,” while the remaining 99% are almost entirely speculative trading, which not only causes losses for users but also wastes on-chain resources, permanently recorded on the blockchain as “on-chain garbage.” Such a massive amount of worthless data is also a burden for nodes and the long-term operation of the blockchain. It can be said that the low threshold of one-click coin issuance is a double-edged sword: it unleashes creativity but also unleashes garbage.

- KOL Manipulation and Speculators: Due to the platform’s lack of background checks, the anonymous environment has provided opportunities for malicious actors. Some cryptocurrency KOLs or large holders leverage their influence to frequently issue coins on these platforms to exploit retail investors. Additionally, professional speculators use bots to monitor all newly issued coins, and once they detect rapid inflows of funds, they follow up to pump the price to attract retail investors, only to instantly dump it afterwards. For regular users, it is difficult to profit without information advantages.

- Rug Pull and Security Risks: Although Pump.fun has reduced the possibility of developers running away with LP locking, “rug pull” has not disappeared, it has just taken on different forms. Some project parties do not directly pull the pool, but reserve a large number of tokens to cash out at a high point, or profit from contract vulnerabilities/backdoors; some unscrupulous developers will add hidden transfer functions based on contract templates, secretly transferring users’ held coins after the token price rises; impersonating well-known projects to issue coins to gain attention, and using social engineering to get users to buy on fake websites. In the midst of frenzy and greed, many people lower their vigilance and are easily deceived.

- Regulatory Gray Area: From a legal perspective, one-click issue coin platforms effectively provide an unregulated ICO market. These platforms, due to their decentralized and anonymous nature, have not yet become direct targets of regulatory crackdowns. However, when users experience widespread losses and public opinion is triggered, platform operators may be held accountable. Once regulatory red lines are crossed, they may face rectification shocks. For users, there is also the issue of difficulties in safeguarding their rights.

6. Future Prospects: The Sustainability and Development Trends of One-Click Issue Coin Platforms

Looking to the future, can the one-click issue coin platform sustain its development in this track, and where will the next phase lead? We can think from three aspects: market, technology, and narrative:

1. Market Sustainability: Return to Project Value

After nearly a year of crazy growth, the Meme issue coin craze has clearly cooled down, and the “get rich quick effect” is difficult to replicate on a large scale. After the wave of淘沙, the one-click issue coin platforms may settle down to a few that operate steadily, continuously providing services for new projects. From the perspective of revenue models, the early Pump.fun’s “harvesting” profit model is not sustainable, and now new platforms are exploring healthier win-win models. For example, guiding creators to improve project quality, supporting promising projects, and eliminating purely scam Tokens.

2. Evolution Direction: From Meme Frenzy to Empowering Innovation

The one-click issue coin platform is essentially a combination application of issuing + liquidity on the blockchain, and its future evolution may have several directions:

- Multi-chain interoperability and layered abstraction allow users to issue coins and trade without perceiving the differences of the underlying chains.

- Introduce more smart contract features, such as options and DAO governance modules, so that new coins come with more gameplay from the moment they are born;

- Integrating with identity and content systems, such as automatically generating NFT badges for original creators, or binding decentralized social identities, making tokens a form of reputation proof, etc.

These technological improvements represent a vision: in the future, Launchpad will not just be a speculative tool, but an incubator for Web3 innovation. If the narrative can successfully transform and win the trust of mainstream developers and entrepreneurs, then the one-click issue coin platform will undergo a qualitative change.

3. A New Paradigm for Web3 Entrepreneurship: Project Cold Start Infrastructure

A developer or creative person has a new Web3 project idea. In the past, they might have needed to write a white paper, seek investment, and assemble a team to create an MVP. Now, they can directly issue a token on the issue coin platform, package their idea into a story, and test community interest through market trading. If the token receives a positive response, they can obtain initial funding to hire a team and develop the product; the community will also become early users and promoters of the project by holding the token. This is almost a new paradigm that disrupts the traditional startup financing model: no VC, no crowdfunding sites, and instead, good ideas are discovered and funded directly by the open market. This will attract more serious entrepreneurs to try this approach, and the issue coin platform will not just be a “token issuance tool,” but will upgrade to become the “project cold start infrastructure,” becoming a part of the Web3 entrepreneurial ecosystem.

4. Compliance and Governance: Finding the Balance

If a one-click issue coin platform wants to have a long-term future, it must find a balance between complete disorder and excessive regulation. Possible directions include: community self-discipline + protocol governance, meaning the platform introduces a set of community guidelines and a DAO governance mechanism to vote to delist or mark warnings on obviously fraudulent or illegal projects; introducing optional KYC/real-name channels, allowing willing founders to prove their identity for higher trust, while also complying with bottom-line requirements such as anti-money laundering monitoring. In addition, strengthening security audits and real-time monitoring of abnormal transactions can also reduce the frequency of malicious incidents.

Conclusion: The one-click issue coin platform has evolved from the dominance of Pump.fun to a current landscape of one strong player and many strong contenders, showcasing the astonishing power of “decentralized creativity” in the crypto world. It has decentralized the power of financial experimentation to the public, giving countless imaginative ideas the opportunity to shine on the chain through tokenization. The future winners may not necessarily be the platforms with the lowest fees, but those that can build content flywheels, community consensus, and platform trust mechanisms, growing into fertile ground for innovation. When every good idea can be freely experimented with in the form of tokens, perhaps that is the kind of future full of infinite possibilities that Web3 strives for.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a “trend judgment + value excavation + real-time tracking” service system. Through in-depth analysis of cryptocurrency industry trends, multidimensional evaluation of potential projects, and around-the-clock market volatility monitoring, combined with the weekly updates of the “Hotcoin Selection” strategy live broadcast and the daily news delivery of “Blockchain Today Headlines,” we provide precise market interpretations and practical strategies for investors at different levels. Relying on cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, jointly seizing the value growth opportunities of the Web3 era.

Statement:

- This article is reprinted from [TechFlow],Original title: 《Hotcoin Research | The War of One-Click Issue Coin Platforms Begins: The Shuffle of Meme Launchpad Starts, Industry Status and Endgame Speculation》,Copyright belongs to the original author [ Hotcoin Research], if there are any objections to the reprint, please contactGate Learn teamThe team will process it as soon as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute any investment advice.

- The other language versions of the article are translated by the Gate Learn team, unless otherwise stated.GateUnder such circumstances, it is prohibited to copy, disseminate, or plagiarize translated articles.

Share

Content