- Topic1/3

22k Popularity

12k Popularity

37k Popularity

8k Popularity

23k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

$7.5 billion in Bitcoin and Ethereum options expire today! Strategy spent $2.1 billion to buy the dip in BTC, becoming a key support.

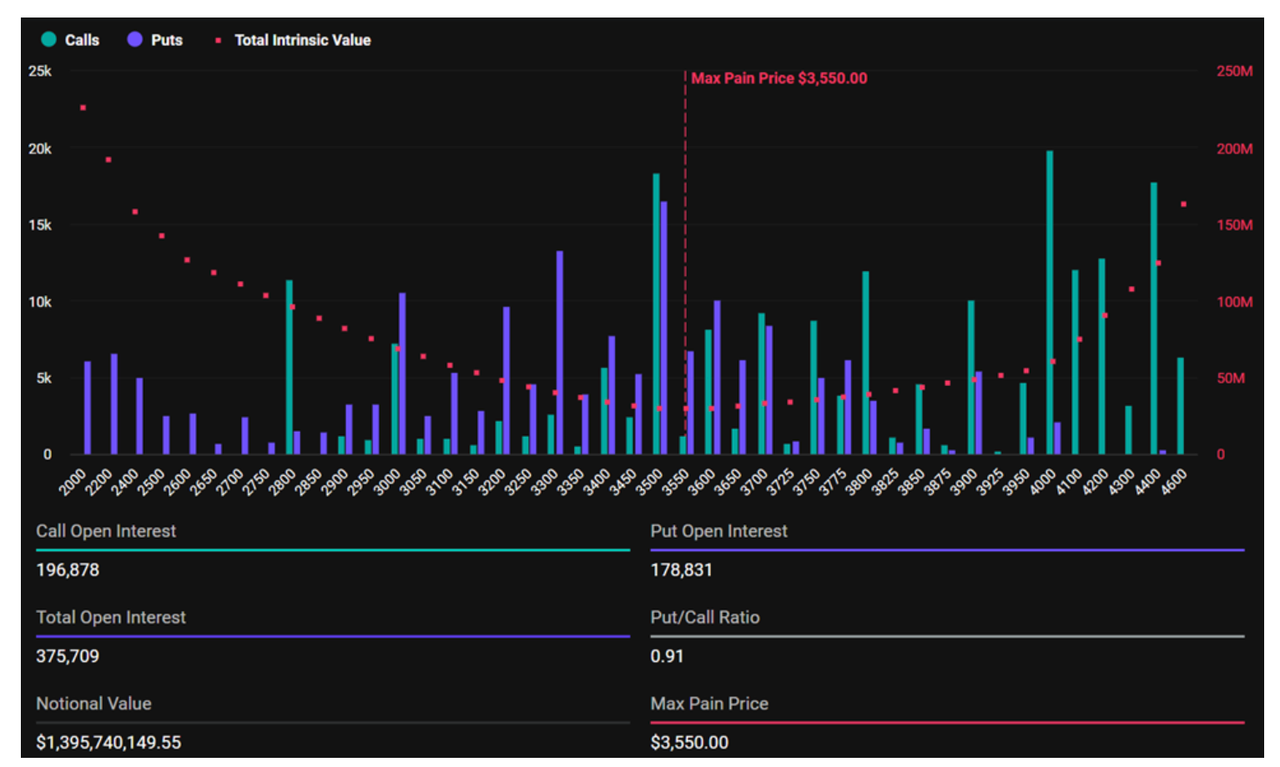

On August 1, the cryptocurrency options exchange Deribit is set to experience a significant delivery day, with BTC and ETH options worth over $7.5 billion about to expire. The maximum pain point for Bitcoin is $117,000 (current price $116,003), and for Ethereum, it is $3,550 (current price above this). The put-call ratio (PCR) indicates that the market remains optimistic, but institutional market stabilization and price magnetic effects hide potential variables. Strategy has invested $2.1 billion to buy the dip in BTC as a key support, and analysts warn of volatility risks over the weekend after the delivery.

7.5 billion Options Peak Approaches: BTC and ETH Face Monthly Delivery Challenge

The cryptocurrency market is facing significant fluctuation challenges! On August 1, 2025, Bitcoin (BTC) and Ethereum (ETH) options worth over $7.5 billion will expire on the Deribit exchange. Like every monthly options expiration event, this week's delivery may also significantly impact the price direction through traders' hedging or closing positions, potentially "pinning" the coin price near key strike prices.

Key Data Insights: Major Pain Points, Open Interest, and Market Sentiment

(Source: Deribit)

** (Source: Deribit)

(Source: Deribit)

**The deep signal of ETH's open interest surpassing BTC's The total amount of open contracts for Ethereum Options has surpassed Bitcoin, and this phenomenon conveys multiple messages: **

Price Magnet Effect: The "Invisible Hand" of Delivery Day

As the expiration approaches, prices are often "magnetically attracted" to the maximum pain point level. The mechanism is as follows:

Long and Short Game: Institutional Support VS Macroeconomic Pressure

Options analysis platform Greeks.live indicates that the current market sentiment is polarized:

Strategy 2.1 billion USD buy the dip becomes a key Market Stabilization force Despite the market pressure, Michael Saylor's Strategy has provided a key buffer for the Bitcoin market:

Conclusion: The total value of $7.5 billion in BTC and ETH options is set to expire, compounded by the aftershocks of Federal Reserve policy and institutional capital support factors, making tonight's market destined for fluctuations. The biggest pain point ($117,000/$3,550) will become the battleground for both bulls and bears, with the price magnetic effect potentially dominating short-term trends. MicroStrategy's $2.1 billion BTC purchase provides some support but also exposes the market's deep reliance on institutional capital flow. Traders must be vigilant about the risk of volatility spikes around the delivery time at 8:00 UTC (16:00 Beijing time). After the delivery is completed, the market may see a brief stabilization, and investors need to quickly adapt to the new balance. In the highly complex game of the cryptocurrency derivatives market, risk management remains the core rule for weathering the storm. The direction of the weekend market will be revealed tonight.