SPAC to the Future

In 2020, Strategy (then known as MicroStrategy) started by swapping out debt and stocks for Bitcoin. The company, which originally sold enterprise software, pivoted under the leadership of cofounder and chairman, Michael Saylor, by loading up their corporate treasury with BTC to become the largest listed Bitcoin holder.

Five years later, it still sells software, except that the gross profit contributed by operations to the overall company has been steadily declining. Gross profit from operations dropped to ~15% in 2024 compared to 2023. In Q1 2025, the same figure decreased by 10% compared to the corresponding period of the preceding year. As of 2025, Strategy’s playbook has been copied, remixed, and simplified, paving the way for over a hundred listed entities to hold Bitcoin.

The playbook was simple: issue cheap debt against your business, buy Bitcoin, watch it appreciate, then issue more debt to buy more Bitcoin – a self-reinforcing loop that turned corporate treasuries into leveraged crypto funds. The maturing debt would be settled by issuing new shares, diluting existing shareholders. But the dilution was offset by the premium on the stock price, driven by the rising value of the company’s Bitcoin holdings.

Read: Asset-Wrapped Equities

Your GPU Deserves a Side Hustle

Neurolov lets you rent out your GPU power directly from your browser. No downloads, no weird setup.

You earn $NLOV by helping run decentralised AI workloads across Solana and beyond.

- Passive GPU income

- In-browser AI compute

- Powered by Solana + $NLOV

Fire up your GPU and earn with Neurolov!

Most of these companies that followed Strategy’s footsteps had existing businesses that wanted to expose their balance sheet to the upside Bitcoin provided as an appreciating asset.

Strategy used to wholly function as an enterprise analytics and business intelligence platform. Meanwhile, Semler Scientific, the 15th largest listed BTC holder, used to function purely as a health-tech company. GameStop, the latest one to turn heads in the Bitcoin treasury club, was known as a gaming and electronics retailer until they recently dipped their toes in building a Bitcoin treasury.

Today, a new wave of companies want the upside of Bitcoin without the baggage of building an actual business. No clients. No revenue model. No operational roadmap. Just a balance sheet loaded with Bitcoin, and a fast track to the public markets via a financial shortcut. Enter, the Special Purpose Acquisition Company, or SPAC.

These Bitcoin treasury SPACs, like ReserveOne, ProCap (backed by Anthony Pompliano), or Twenty One Capital (backed by Tether, Cantor Fitzgerald and Softbank), are launching simple wrappers. Their proposition is clean: raise hundreds of millions, buy Bitcoin in bulk, and give public market investors a stock ticker to track it all. That’s it. That’s the business.

These new entrants are doing the opposite of what Strategy did: first accumulating, and coming up with the business part later. The model feels more hedge fund than enterprise.

Yet, there’s a queue of them lining up to take the SPAC route. Why?

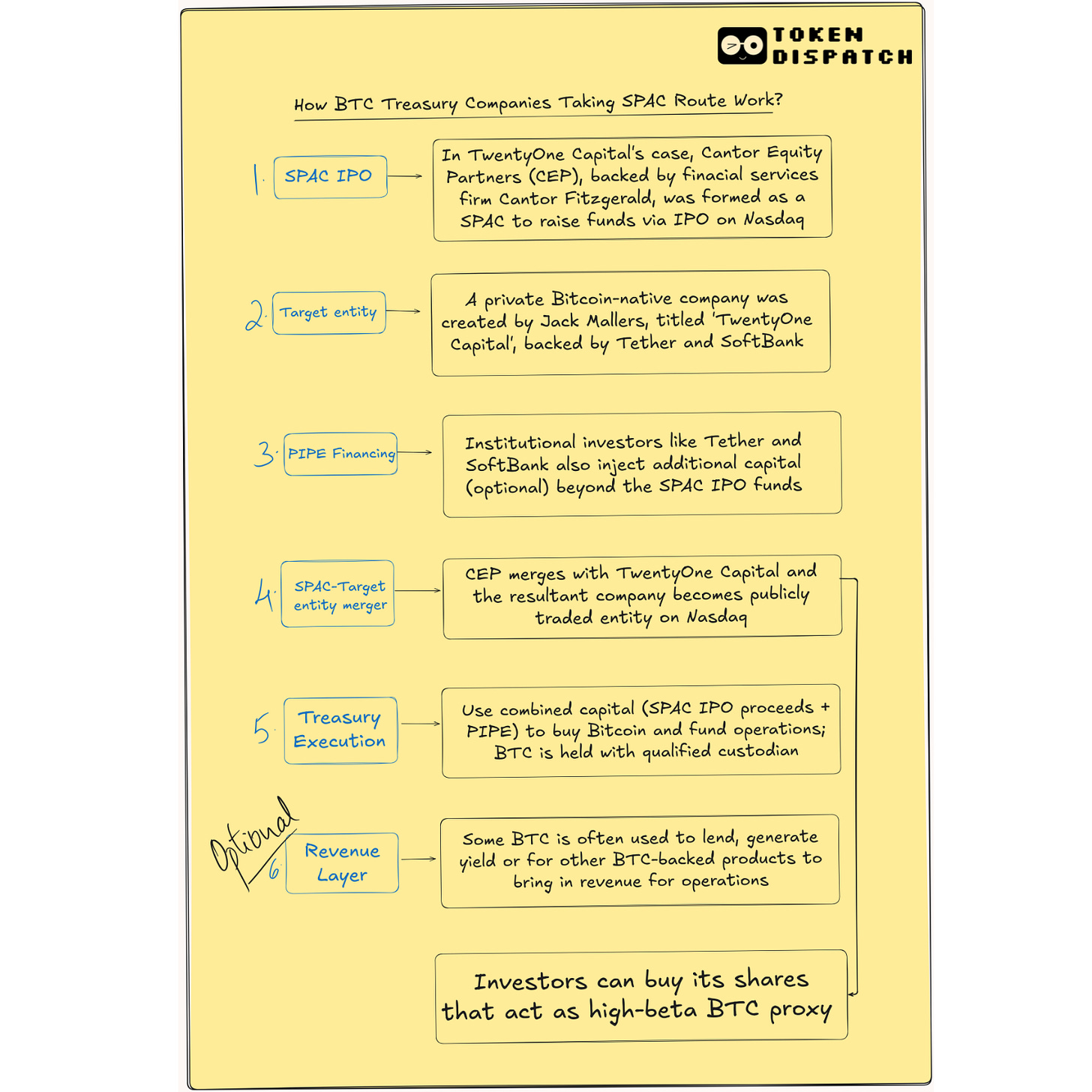

The SPAC is a pre-funded shell company that raises money from investors, often from a group of private individuals, lists on a stock exchange, and then merges with a private company. It’s often described as a shortcut to IPO. And in crypto’s case, it’s a way to get a Bitcoin-heavy entity listed fast, before sentiment or regulation shifts against it. Speed is of the essence.

Though this “speed advantage” could often be illusory. While SPACs promise a 4-6 month timeline as opposed to 12-18 months for IPOs, in reality, regulatory reviews for crypto companies take longer. For instance, Circle’s attempted SPAC listing failed and was followed by a successful traditional IPO.

Yet, SPACs have their perks.

They allow these firms to pitch bold visions: “$1 billion in Bitcoin holdings by year-end”, without the immediate scrutiny of a traditional IPO process. They can pull in Private Investment in Public Equity (PIPE) deals from heavyweight firms like Jane Street or Galaxy. They can negotiate valuation up front and wrap it in an SEC-compliant shell, all while sidestepping the label of being an investment fund.

The SPAC route just makes it easier for a company to pitch their strategy to their stakeholders and investors since there is, well … nothing else to pitch except Bitcoin.

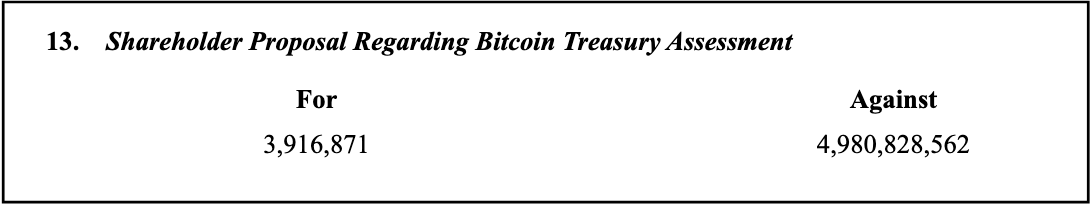

Remember what happened when the likes of Meta and Microsoft considered adding Bitcoin to their treasury? Overwhelming rejection.

For public investors, SPACs come across as vehicles that promise pure-play Bitcoin exposure, without needing to touch crypto directly. It’s like buying into a gold ETF.

SPACs do face adoption challenges from retail investors who prefer more popular routes to gain Bitcoin exposure. Think exchange-traded funds (ETFs). A 2025 Institutional Investor Digital Assets Survey showed that 60% investors prefer to gain exposure to crypto through registered vehicles such as ETFs.

Still, demand exists. Because this model taps into the promise of leverage.

When Strategy bought Bitcoin, it didn’t stop with one purchase. It kept going, issuing more convertible notes that will most likely be redeemed by issuing new stock. This approach helped an erstwhile business intelligence platform become a Bitcoin turbocharger. On the way up, its stock outpaced Bitcoin itself. That blueprint lingers in the minds of investors. A SPAC-based Bitcoin company can offer the same acceleration: buy BTC, then issue more shares or debt to buy more. Rinse, repeat. It’s a loop.

When a new BTC firm announces a $1 billion PIPE backed by institutions, it signals credibility. It’s a way of showing the market that serious money is paying attention. Think of how much credibility Twenty One Capital commanded with heavyweights like Cantor Fitzgerald, Tether and Softbank backing the company.

SPACs allow founders to do this earlier in the lifecycle, without having to build a revenue-generating product first. That early institutional validation helps attract attention, capital, and momentum with fewer obstacles that already listed businesses might face from their investors.

For many founders, the SPAC route is about flexibility. Unlike IPOs, where disclosure timelines and pricing are rigid, SPACs offer more control over narrative, projections, and valuation negotiations. Founders can tell a forward-looking story, craft a capital plan, and preserve equity, all while avoiding the fundraising treadmill of traditional VC-to-IPO playbooks.

The wrapper itself is part of the appeal. Public equity is a known language. A ticker can be traded by hedge funds, added to retail platforms, and tracked in ETFs. It’s a bridge between crypto-native ideas and traditional market infrastructure. For many investors, that wrapper matters more than the underlying mechanism. If it looks like a stock and trades like a stock, it fits into existing portfolios.

The Revenue Question

If SPACs can set shop and go public without any existing business, how do they operate? Where does the revenue come from?

SPACs also allow for creativity in structuring. A company could raise $500 million, put $300 million into BTC, and use the rest to explore yield strategies, launch financial products, or acquire other crypto businesses that can help make revenue. This kind of hybrid approach is hard to pull off under ETF or other models where rules are tighter and mandates are rigid.

Twenty One Capital is looking at structured treasury management. It holds over 30,000 in its BTC reserve while using a portion of it for low-risk, on-chain yield strategies. It merged with a Cantor Fitzgerald-sponsored SPAC and raised over $585 million in PIPE and convertible debt financing to purchase more Bitcoin. Its roadmap includes building Bitcoin-native lending models, capital market instruments, and even producing Bitcoin-focused media and advocacy.

Nakamoto Holdings, founded by David Bailey of Bitcoin Magazine, took a different path to a similar outcome. It merged with a listed healthcare firm, KindlyMD, to build a Bitcoin treasury strategy. That deal came with $510 million in PIPE and $200 million in convertible notes, making it one of the largest crypto-related capital raises ever. It wants to securitise Bitcoin exposure into equity, debt, and hybrid instruments that can live on every major stock exchange.

Pompliano’s ProCap Financial, on the other hand, plans to offer financial services on top of its BTC treasury. That includes crypto lending, staking infrastructure, and building products that allow institutions to access Bitcoin yield.

ReserveOne is taking a more diversified route. While Bitcoin remains central to its portfolio, it plans to hold a basket of assets, including Ether and Solana, and use them to participate in institutional-grade staking, derivatives, and over-the-counter lending.

Backed by firms like Galaxy and Kraken, ReserveOne is positioning itself as a sort of crypto-native BlackRock, blending passive exposure with active yield generation. The revenue, in theory, comes from lending fees, staking rewards, and managing the spread between short- and long-term bets across crypto assets.

Even if the entity has figured out how to make sustainable revenue, its ‘publicly-listed’ tag brings with it paperwork and challenges.

Post-merger operations only reinforce the need for a sustainable revenue model. Treasury management, custody, compliance and audit, all become critical, especially when the only product is an asset that is still maturing in terms of volatility. Unlike ETF issuers, many of these SPAC-backed firms are building from scratch. Custody might be outsourced. Controls might be thin. The risks multiply quietly, but quickly.

Then, there’s also the problem of governance. Many SPAC sponsors retain special rights such as enhanced voting power, board seats and liquidity windows. But they often lack crypto expertise. It’s important to have an expert who knows how to steer the ship if and when BTC tanks or regulations tighten. When markets are up, nobody notices. When they drop, it gets ugly.

So, where does that leave the retail investor?

Some will be drawn to the upside — the idea that a small bet on a Bitcoin SPAC could echo Strategy’s boom. But they’ll also be exposed to layered risks such as dilution, volatility, redemption cliffs, and management teams with untested track records. Others might prefer the cleaner simplicity of a spot Bitcoin ETF, or even direct Bitcoin custody.

Because when you buy a SPAC-born BTC stock, you’re not buying direct exposure to Bitcoin. You’re buying someone else’s plan to buy it for you, and hoping they do it well. That hope has a price. And in a bull market, that price might feel worth paying.

Yet, it’s worth knowing what you’re actually buying and how much.

That’s it for this week’s deep-dive. I’ll see you next week.

Until then … stay curious,

Disclaimer:

- This article is reprinted from [TOKEN DISPATCH]. All copyrights belong to the original author [Prathik Desai)]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Share