The situation in the Middle East is turbulent. What does Polymarket think?

Recently, news regarding the conflict between Iran and Israel has dominated the front pages of major news outlets. For people caught in the turmoil and users in a global information network, a real-time and effective information source holds significant value. As prediction markets have gradually gained attention as a primary source of information in recent years, and are set to shine in the 2024 U.S. elections, the opinions on topics within these markets are also building their reference value for people. This article provides a brief overview of the fluctuations in opinions during the recent conflict.

Earlier on June 18, social media widely circulated that “a huge surprise is coming - a surprise that the world will remember for centuries,” but no details were provided. Meanwhile, Rafael Grossi, Director General of the International Atomic Energy Agency (IAEA), stated on Wednesday that the 409 kilograms (902 pounds) of highly enriched uranium possessed by Iran may have been transferred, raising concerns in the market about the possibility of Iran using a nuclear bomb in retaliation. However, on Polymarket, traders are not optimistic about the likelihood of Iran using a nuclear bomb in 2025; it quickly surged to 20% on June 18 but fell back to 13% within the following day.

In terms of news, both Israel and the United States have plans to strike Iran’s nuclear facilities to varying degrees, and European senior diplomats will hold nuclear negotiations with Iran in Geneva, which somewhat mitigates this possibility. However, the nature of the U.S. negotiations on Iran’s nuclear issue is rather lukewarm, with a 42% probability of the U.S. and Iran resuming nuclear talks before July; a 16% probability of reaching a new nuclear agreement before July; a 49% probability of reaching an agreement this year; and a 28% probability that Trump will withdraw from the Iran nuclear negotiations before July. Against the backdrop of the existing conflict and hopes for peace talks, traders estimate that the probability of Iran ending uranium enrichment before August is 32%, and the probability of a ceasefire between Israel and Iran before July is also roughly between 22-23%.

As tensions escalate, maritime agencies have advised ships to avoid Iranian waters when heading to the Strait of Hormuz. On June 19, Iran’s former Minister of Economy Ehsan Khandouzi stated, “Starting tomorrow, within 100 days, no oil tanker or liquefied natural gas cargo ship may pass through the strait without Iranian approval.” Although this was not an official statement, its timing and Khandouzi’s high-ranking position may reflect broader sentiments within Iran or serve as a warning for future events. Traders predict a 21% probability that Iran will block the Strait of Hormuz before July and a 37% probability of a blockade within the year.

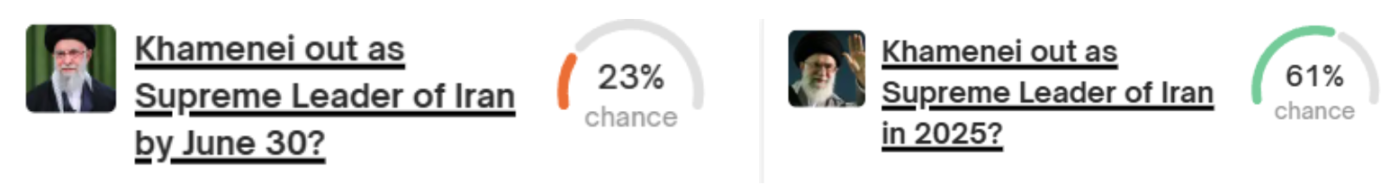

On June 16, Trump issued a statement demanding Iran’s “unconditional surrender” and warned of possible strikes against Iranian leader Khamenei. On June 17, Iranian state media revealed that the Supreme Leader Khamenei had not appeared in public for five consecutive days and had begun secretly arranging to transfer supreme power to the Supreme Council of the Iranian Revolutionary Guard, rather than to his son Mojtaba as previously speculated. This move indicates that, in the face of unprecedented military pressure from the US and Israel, the 86-year-old Khamenei is preparing for the worst to ensure the regime can continue after any unforeseen events. However, Trump stated that he would not take action to remove the Iranian Supreme Leader for the time being. Meanwhile, traders predict that the probability of Khamenei stepping down this year is 61%, with a 23% chance of him stepping down before July.

Israeli officials estimate that the U.S. may join the war against Iran on the evening of the 17th, but U.S. President Trump refused to disclose on June 18 whether the U.S. plans to join Israel’s military action against Iran, stating that Tehran has made contact with the U.S. regarding the possibility of negotiations. In terms of the likelihood of troop deployment, traders are more inclined to buy into the prospects of U.S. military action against Iran, with the predicted probability of action before July reaching 67%. Traders even predict a 42% chance of Iran being overthrown by 2025. French President Macron expressed opposition to violently overthrowing the Iranian regime on the 17th, warning that it could lead to destabilizing effects across the Middle East.

As one of Iran’s important nuclear facilities, the Fordow enrichment facility is under strategic attention from the US and Israel, while CNN cites sources saying that Trump is increasingly inclined to strike Iran’s nuclear facilities. According to Bloomberg, the US is considering launching an attack on Iran this weekend, with the Fordow nuclear facility being the main target of the attack. Traders also expect the probability of a US strike on the Fordow nuclear facility to rise to 61% before July, and the probability of the facility being destroyed before July has also reached 60%.

The recent tensions surrounding the conflict between Iran and Israel have triggered a series of chain reactions and international attention. Predictive markets and developments indicate that the core risk of the conflict is focusing on the possibility of the United States taking direct military action against Iran’s critical nuclear facilities, particularly Fordow, with a significantly increased likelihood of a broader confrontation in the short term. At the same time, signs of a precautionary power transfer within the Iranian regime reflect its high concern for the continuity of its rule under immense pressure.

Despite concerns over the direct use of nuclear weapons being assessed by the market as a low short-term possibility, and the complete blockade of the Strait of Hormuz not being imminent, the spiral escalation of conflict and the potential threat to key energy routes have sharply increased regional security risks. Overall, the situation is evolving towards intensified direct military confrontation between the U.S. and Iran, with challenges to the stability of the Iranian regime, while the international community is on high alert for the possibility of further escalation of the conflict.

Declaration:

- This article is reprinted from [Foresight News] The copyright belongs to the original author [Pzai, Foresight News], if you have any objections to the reprint, please contact Gate Learn TeamThe team will process it as soon as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team, unless otherwise mentioned.GateUnder such circumstances, copying, disseminating, or plagiarizing translated articles is not allowed.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge