Deutscher

Deutscher

No content yet

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

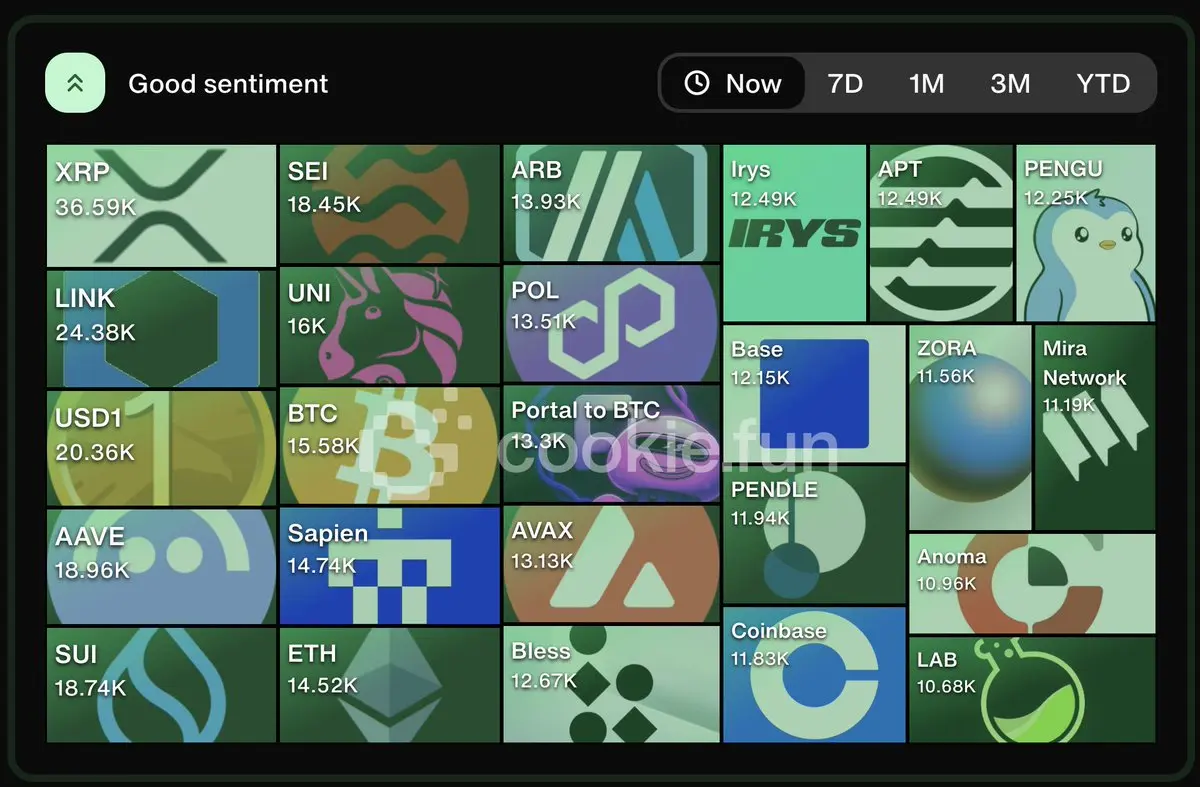

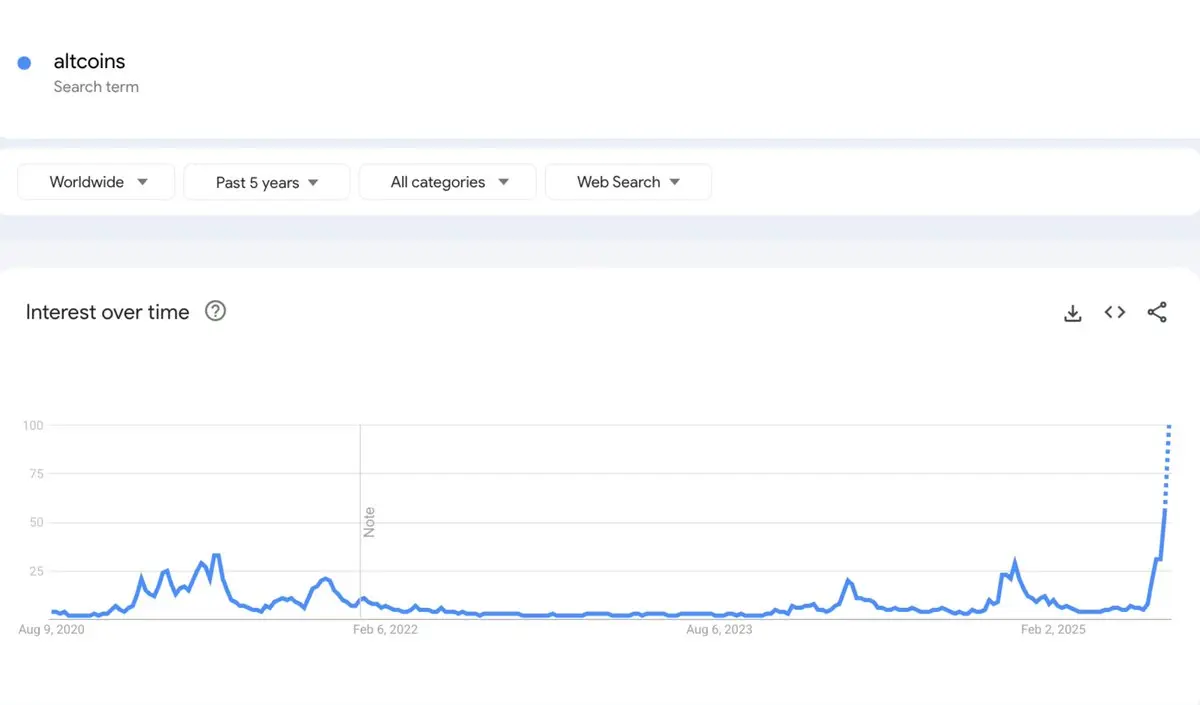

Google searches for "altcoins" just entered price discovery..

Retail interest is coming back.

Retail interest is coming back.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Interesting data from @YashasEdu.

In major bull runs, $ETH typically hits 35% of Bitcoin's mcap.

2017: ~35%

2021: ~36%

Based on BTC's current market cap, this should put $ETH around $6k (still lagging, but starting to catch up).

At $150k $BTC, this would put $ETH at $8k+.

In major bull runs, $ETH typically hits 35% of Bitcoin's mcap.

2017: ~35%

2021: ~36%

Based on BTC's current market cap, this should put $ETH around $6k (still lagging, but starting to catch up).

At $150k $BTC, this would put $ETH at $8k+.

- Reward

- like

- Comment

- Repost

- Share