Protocols Building with Intent-Based Architecture

This module covers the protocols leading the shift to intent-based design—like Uniswap X, CowSwap, Anoma, Anvil, and Flashbots SUAVE. Each project offers a different take on how to implement and fulfill user intents. You’ll see how these systems improve execution quality, protect privacy, and unlock more flexible, goal-based workflows.

A new category of infrastructure

As the intent-based model gains momentum, an increasing number of protocols are building native support for intents into their architecture. This movement reflects a deeper shift in how decentralized systems are being designed, not around smart contract function calls, but around abstract user goals that solvers or execution engines fulfill on their behalf. Some projects are integrating intents as an enhancement to existing products, while others are building full-stack platforms where intents are the primary method of interaction.

Unlike traditional dApps that require users to interact directly with individual contracts, these intent-based protocols introduce a marketplace for fulfillment. In this marketplace, competition between solvers drives better pricing, faster execution, and lower failure rates. More importantly, they blur the lines between chains, assets, and execution logic. As we’ll see, each project offers its own vision of what an intent-centric DeFi future looks like.

Uniswap X

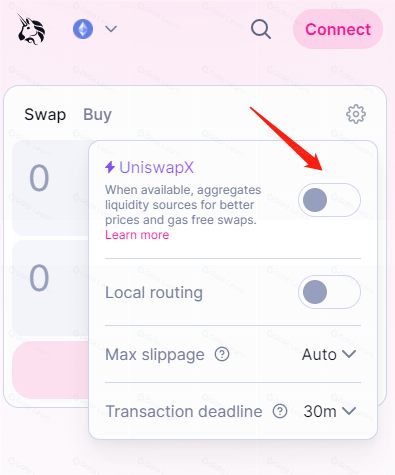

Uniswap X, launched in 2023, marked one of the first large-scale implementations of intent-based design within an established DeFi ecosystem. Rather than having users directly interact with liquidity pools on-chain, Uniswap X introduced an RFQ (request-for-quote) system where users submit swap intents off-chain. Solvers then compete to fulfill those intents with the best possible execution path, sourcing liquidity from multiple venues and settling the transaction in a single step.

The innovation here lies in the separation of the swap intent from the route taken. A user on Ethereum might intend to trade ETH for USDC, but the solver could decide that bridging ETH to Optimism, swapping via SushiSwap, and returning USDC to the user’s wallet provides a better outcome. Uniswap X abstracts this logic from the user and makes the experience seamless.

Critically, Uniswap X also introduces the concept of self-custodial settlement, where users remain in control of their funds until a solver delivers the desired output. Transactions only complete if the fulfillment matches the user’s declared constraints, ensuring safety and minimizing risk.

CowSwap

CowSwap is one of the earliest projects to build around intent-based execution, though it didn’t initially use that term. Its architecture centers on a unique batch auction mechanism, where user orders (intents) are submitted over a short period and then matched in a way that maximizes value for all participants. Solvers submit settlement strategies for the batch, and the best strategy—based on pricing and efficiency—is selected.

This system minimizes MEV by preventing frontrunning and exploiting solver competition. Rather than users sending transactions directly to the blockchain, they broadcast signed messages to CowSwap, and solvers fulfill them based on shared auction outcomes. All settlements are atomic, so users never lose funds due to partial execution.

What sets CowSwap apart is its fairness model. Because solvers operate in a sealed-bid environment, they cannot front-run each other or extract value through privileged ordering. The batch model also allows for coincidence-of-wants matching, where trades are executed without touching liquidity pools if two users’ intents naturally align.

Anoma

While projects like Uniswap X and CowSwap added intents to existing models, Anoma is building an entirely new protocol stack where everything begins with an intent. In Anoma’s architecture, users never send transactions in the traditional sense. Instead, they publish intents describing what they want to achieve. These intents can be as simple as a token swap or as complex as a conditional privacy-preserving transaction that only executes under specific market conditions.

The Anoma system groups intents into match bundles, where solvers coordinate fulfillment across multiple users. Settlement is conducted in a shared state environment that allows multi-party execution and composability without direct coupling between smart contracts.

Privacy is also a core feature. Using zero-knowledge proofs and shielded execution environments, Anoma ensures that intent contents can be hidden until execution, reducing MEV exposure and offering programmable privacy. This makes it possible to compose secure, private workflows without sacrificing the benefits of decentralization.

Anoma introduces an entirely new economic model around intents, including fee sharing, trust networks, and dynamic routing between execution layers. It’s not just a protocol—it’s a blueprint for building intent-centric chains.

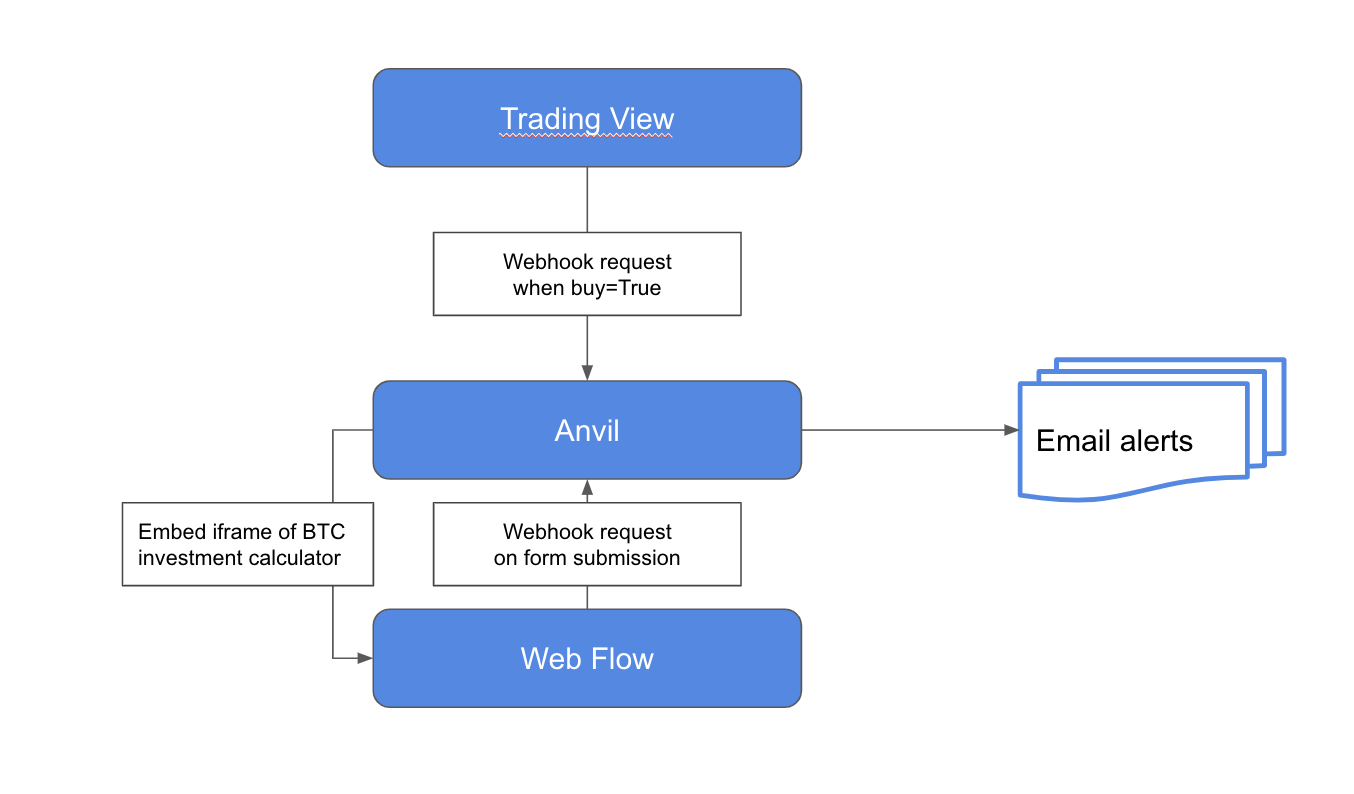

Anvil

Anvil takes a different approach by acting as a shared execution layer that other protocols and chains can plug into. Rather than building a standalone DeFi platform, Anvil focuses on composable settlement infrastructure that supports intent matching and fulfillment across multiple ecosystems.

In Anvil’s model, users submit intents to a shared mempool, which is accessible by solvers and searchers. These actors then attempt to bundle multiple intents into efficient transaction batches, taking into account gas costs, chain congestion, and liquidity availability. The resulting bundles are passed to validators for execution, often across multiple chains simultaneously.

Anvil’s key contribution is composability. It enables apps and protocols to outsource fulfillment logic to a standardized intent engine, simplifying the developer experience. Projects don’t need to build their own execution logic—they just need to define the intent schema and settlement constraints. Anvil handles the rest.

This layer is particularly attractive for emerging DeFi applications that want to support multi-chain strategies, liquidity abstraction, or modular execution without rebuilding core infrastructure.

Flashbots SUAVE

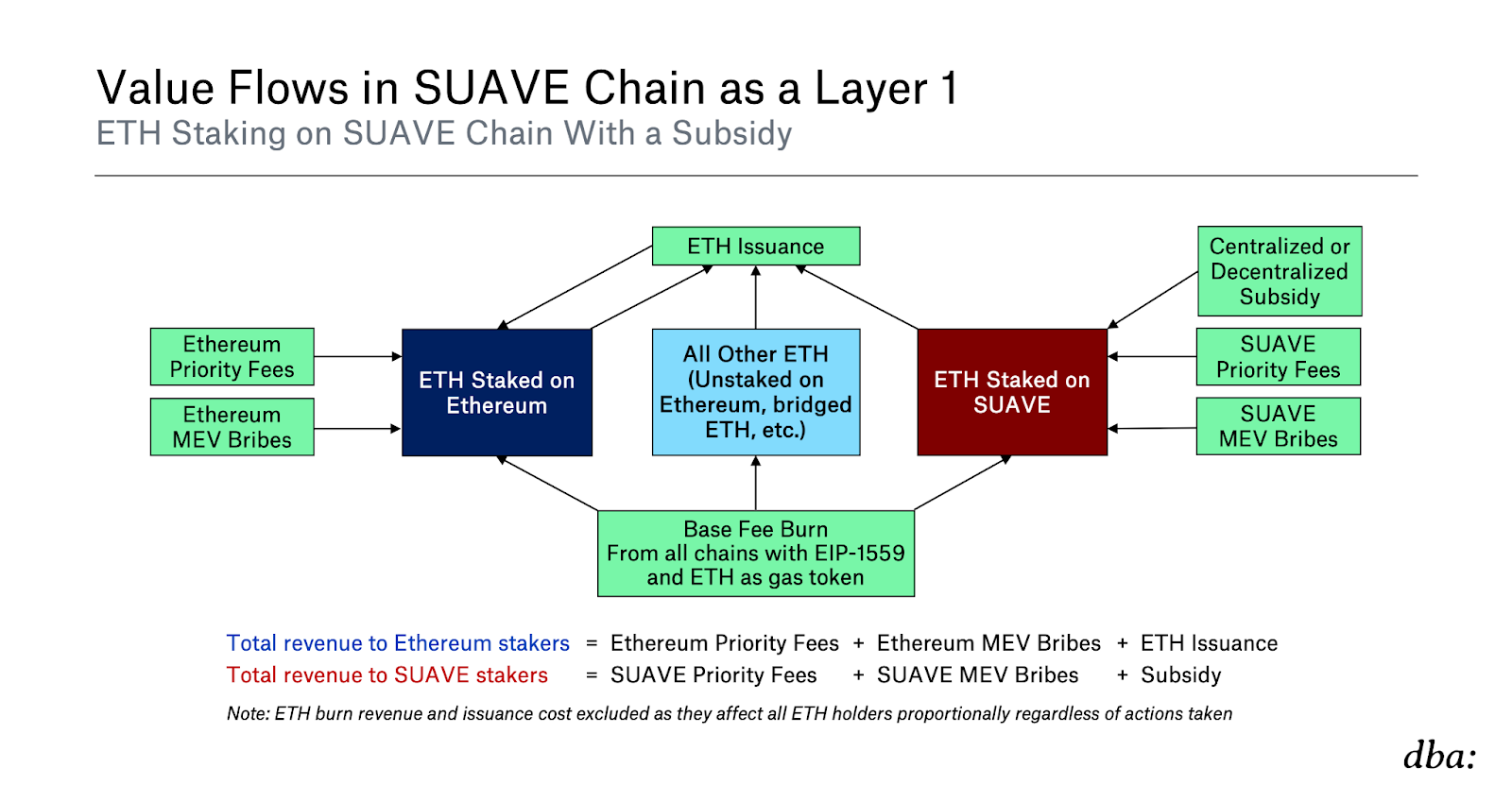

Flashbots’ SUAVE (Single Unified Auction for Value Expression) extends its work on MEV mitigation into the intent-based realm. SUAVE proposes an intent auction layer, where users and protocols broadcast intents into a shared system and solvers—known as executors—compete to fulfill them.

Unlike typical searchers in Ethereum’s MEV ecosystem, SUAVE executors do not work on individual transactions. Instead, they assemble optimal bundles of intents, including swaps, trades, and liquidations, and then auction the right to execute them. Validators choose the best bundle based on fee incentives, fairness, or privacy guarantees.

SUAVE is designed to be chain-agnostic, allowing intents and execution logic to move between Ethereum, rollups, and alternative L1s. It also supports confidential computing environments, where bundles can be built and verified without revealing their contents publicly. This opens new design space for private coordination, trustless delegation, and fair order flow in intent-driven markets.

SUAVE’s long-term vision is to replace the current validator-first model with an intent-first paradigm, where user goals, not block space, are the core economic unit of value.

A comparative view of protocol approaches

Each of these protocols tackles the intent challenge from a different angle. Uniswap X optimizes execution paths for token swaps. CowSwap focuses on fairness and batch efficiency. Anoma reimagines the blockchain stack from scratch to support intent-first workflows. Anvil standardizes fulfillment logic across chains, while SUAVE introduces a shared auction layer that maximizes intent execution value.

What they share is a belief in the value of abstraction, optimization, and user-centric design. In each system, users are shielded from low-level decisions. They declare what they want, and the infrastructure finds the best way to make it happen.

For developers, this opens a new frontier. Instead of building yet another swap router, they can now design applications around user goals. Instead of forcing users to understand gas markets, slippage tolerances, or bridging risks, front-ends can focus on clean interfaces that translate real-world objectives into machine-readable intents.

The evolving design space for intent protocols

As these protocols mature, they are beginning to explore new use cases beyond simple swaps. Portfolio rebalancing, structured product deployment, credit underwriting, and real-world asset trades are all being rebuilt using intent logic. Users can now express rich financial behaviors, like “lend $10,000 stablecoins for a fixed 4% APY for 30 days, only if the borrower is KYC-verified” without scripting them manually.

Protocols are also building around intent registries, execution credits, and composable fee models, enabling a modular ecosystem of intent submission, bundling, fulfillment, and verification. This mirrors the way RPC providers, relayers, and validators created an execution stack in the early Ethereum ecosystem, but focused on goal-based computation instead of static function calls.

Interoperability is another frontier. Some projects are working on shared intent formats, allowing a single intent to be fulfilled across multiple protocols or matched across networks. This would make intents portable, composable, and universally discoverable, further blurring the line between applications and execution engines.

Why protocol-level intent integration matters

The movement toward intent-based architecture is not just about user convenience. It reflects a deeper understanding of how decentralized systems must evolve to serve broader, non-technical audiences. Protocols that support intents inherently shift complexity away from the user and toward the infrastructure. This makes finance more accessible, more intelligent, and ultimately more human.

For Web3 to reach mass adoption, users must be able to describe their goals, not navigate chains, bridges, and routers. Protocols that build for intents are already leading the way—abstracting fragmentation, reducing risk, and unlocking a future where DeFi feels less like programming and more like requesting an outcome.