Use Cases for Traders, Builders, and Institutions

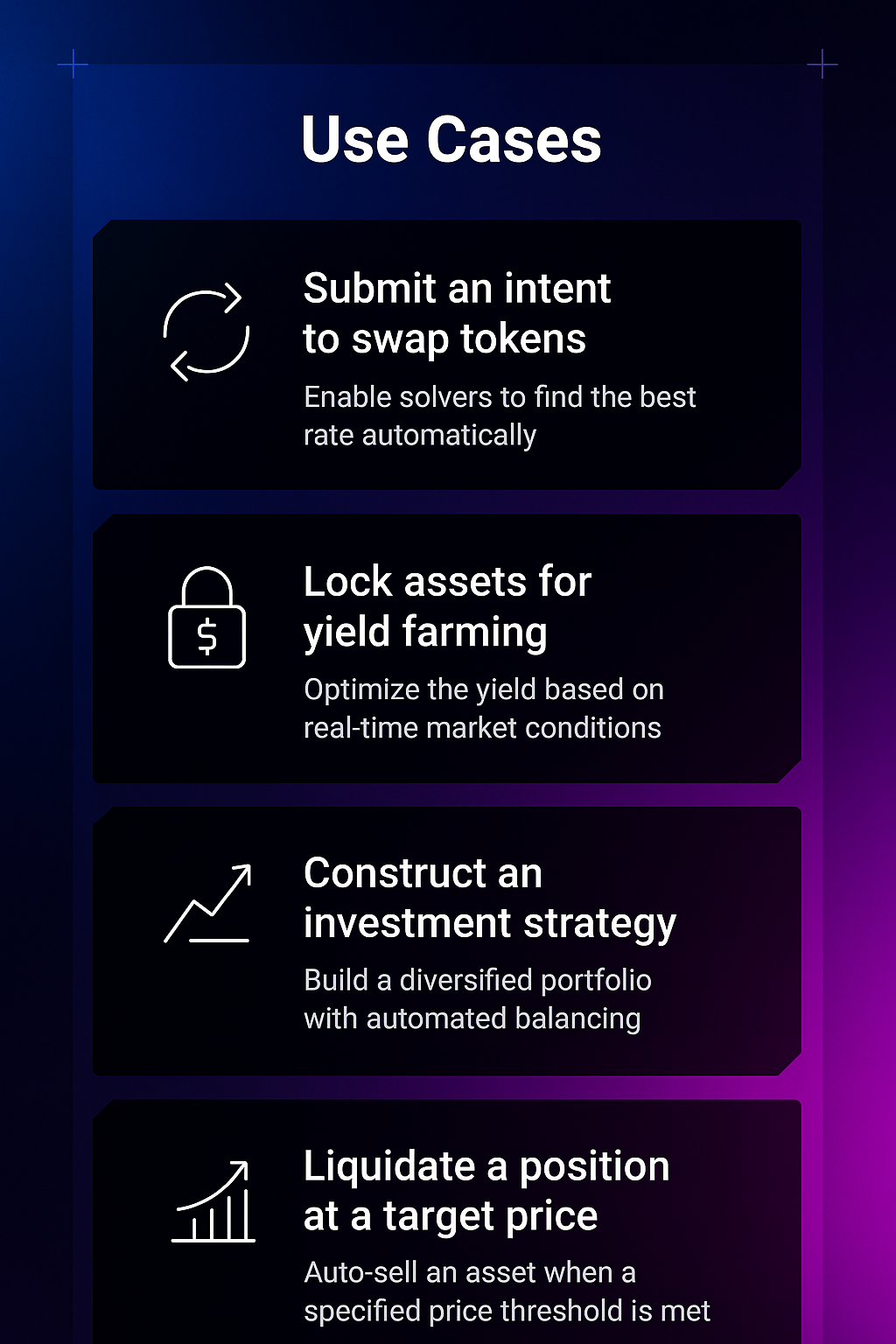

You’ll explore how intents are already being used across the DeFi landscape. From one-click swaps and portfolio rebalancing to institutional RFQs, lending, strategy automation, and gasless onboarding. This module shows how intents create better outcomes for users, developers, and investors.

Intents as an engine for real-world activity

In this module, we explore where intent-based DeFi is already delivering value. These are not hypothetical applications—they represent real implementations, user workflows, and integrations that demonstrate the growing relevance of intent-based systems. Whether it’s enabling gasless trading, simplifying cross-chain transactions, or building automated financial agents, the intent model is proving its capacity to solve core challenges across user segments.

Cross-chain swaps without bridges

One of the most visible use cases for intents is simplifying cross-chain token swaps. In traditional DeFi, moving value from one chain to another requires a bridge interaction, often followed by a token swap on the destination chain. This process includes multiple steps, wallet connections, transaction approvals, and fees.

With intent-based architecture, users no longer need to know or care about how to move assets between chains. A user might submit a simple intent: “Swap 1 ETH on Ethereum for the maximum amount of USDC on Arbitrum.” Behind the scenes, a solver identifies the best path, which might involve bridging ETH via Hop or Stargate, swapping it on an Arbitrum-based DEX, and returning USDC to the user’s wallet. The user receives the result they asked for, and the entire interaction feels like a single action.

This functionality is particularly important in a multi-chain world, where applications and liquidity are fragmented across L1s and rollups. Intent-based routing removes the cognitive burden of navigating chains and creates a seamless user experience that resembles centralized platforms but with decentralized guarantees.

One-click portfolio rebalancing

For users managing diversified crypto portfolios, periodic rebalancing is a common but tedious task. Achieving a target allocation across assets like ETH, USDC, stETH, and stablecoin yield tokens usually requires multiple trades, slippage management, and careful routing to minimize fees.

Intents allow users to rebalance in a single step. A user could submit an intent like “Rebalance my wallet to a 50% ETH, 30% USDC, and 20% stETH allocation,” and solvers compete to deliver that outcome. Each solver may use a different combination of liquidity sources, cross-chain settlements, and execution strategies—but all aim to fulfill the user’s goal within defined constraints.

This has particular relevance for smart wallets and vault-based asset managers, who can integrate intent fulfillment into user interfaces or automated strategies. The result is simplified portfolio management with dramatically reduced complexity and better execution outcomes.

Institutional RFQs and private liquidity

While retail use cases often emphasize automation and UX, institutional participants are drawn to intents for a different reason: control and privacy. Over-the-counter (OTC) trading desks and asset managers regularly execute large trades that must be fulfilled without revealing the full size or intent of the order.

Intent-based RFQ systems, like those used in Uniswap X, allow institutional actors to express trade intents off-chain and receive private quotes from multiple solvers. The selected quote can be fulfilled with guaranteed execution parameters, minimizing price impact and front-running risk.

These mechanisms extend beyond swaps. Intents can be used to express interest in lending capital, issuing structured products, or accessing real-world asset markets under specific legal or compliance conditions. The format is highly expressive, allowing for structured deals without direct protocol interaction.

As regulatory frameworks evolve, intents may also serve as a compliance layer—enabling transactions that meet KYC, AML, or jurisdictional criteria to be executed by permissioned solvers. This offers institutions a pathway into DeFi that aligns with regulatory expectations while preserving the benefits of decentralized settlement.

Automating strategy execution with smart agents

Intents also create opportunities for automation—particularly when paired with smart agents, bots, or even AI models. Instead of waiting for users to manually sign each transaction, agents can monitor market conditions and submit intents when predefined triggers are met.

For example, a user might create a strategy that rebalances their portfolio if ETH volatility exceeds a certain threshold. Rather than coding this into a script or relying on a DeFi front-end, the agent simply submits an intent like “Rebalance to 80% USDC if ETH price falls 10% in 24 hours.” Solvers then execute that intent when the conditions are met, and the user receives the result without active participation.

This style of interaction turns DeFi into a goal-oriented system. Rather than micromanaging every trade or adjustment, users can define intent-based conditions and delegate execution to trusted infrastructure. This unlocks new types of passive participation, autonomous vaults, and programmable yield strategies.

When paired with account abstraction and smart wallets, these agents can operate gaslessly, making DeFi more accessible to mobile-first and non-technical users.

Safer, more efficient lending and leverage

Lending and leverage protocols also benefit from intent-based execution. In many cases, users want to achieve a financial objective—such as opening a leveraged position or migrating collateral—but must manually construct a sequence of transactions to do so. This often includes borrowing, swapping, staking, or supplying assets across different protocols.

With intents, users can describe these actions as a single outcome: “Open a 3x long position on ETH using USDC as collateral, with liquidation at 30% drawdown.” Solvers handle the rest—optimizing for gas, protocol selection, and capital efficiency.

Some lending platforms are experimenting with undercollateralized loans or protocol-to-protocol credit lines fulfilled via intents. Here, the intent serves as a flexible offer: “Lend 50,000 USDC to verified borrower X at 6% APY, with repayment in 90 days.” If a solver can match that intent with the right counterparty, the loan is executed automatically.

This model supports more expressive lending markets, where terms can be negotiated off-chain and settled on-chain only when an intent match occurs. It also supports dynamic risk modeling, as solvers can integrate oracle data, credit scores, or reputation systems into fulfillment decisions.

Use in structured products and composable vaults

Structured products—such as fixed-yield notes, options vaults, and liquidity tranches—are typically hard-coded into specific smart contracts, limiting flexibility and customizability. Intent-based DeFi offers an alternative, where users can define the payout logic they desire and allow protocols to compose them dynamically.

For example, a user might declare: “Invest $5,000 in a 30-day USDC product with capped upside and 2% fixed return.” Multiple protocols could compete to fulfill that product using different hedging strategies, market-making approaches, or fixed-income instruments.

In DeFi-native structured products, intents are also enabling new forms of liquidity management. Composable vaults that support strategy layering can accept user intents as inputs and construct dynamic portfolios based on real-time opportunity sets. Instead of locking into a fixed vault logic, users gain access to flexible yield engines that evolve over time.

This design pattern is increasingly being adopted by asset management protocols, structured stablecoin platforms, and options marketplaces looking to offer more tailored products to advanced users.

Improved UX and onboarding for new users

Perhaps the most transformative use case of intents is also the most basic: simplifying how new users interact with DeFi. Today’s interfaces require technical understanding of chains, wallets, gas, approvals, slippage, and bridging. Each of these creates drop-off points in the user journey.

With intents, onboarding can be reduced to a single action. A user connects their wallet and expresses an outcome: “Buy $100 worth of ETH and start earning yield.” The platform constructs an intent and routes it to solvers, who handle everything from fiat conversion to asset routing and protocol deposits.

The experience becomes fluid, almost invisible. Users no longer need to approve tokens, manage signatures, or even know which chain they’re on. The interface becomes a true financial assistant—translating human intent into decentralized action without friction.

This model is especially well-suited for mobile users, neobanks, and retail apps targeting global users with limited DeFi exposure. By removing unnecessary steps and offering predictable outcomes, intents can unlock the next wave of DeFi growth.

Intent bundling, delegation, and shared fulfillment

As systems mature, more complex behaviors are emerging around intent bundling and delegated execution. Users can submit multiple intents as a group, such as “stake rewards, rebalance position, and withdraw to cold wallet,” and solvers fulfill them in sequence or in parallel.

Delegation allows users to approve specific agents or protocols to fulfill intents on their behalf. For example, a DAO treasury could authorize an execution layer to manage daily swaps, liquidity positions, or risk exposure without needing to pass a proposal each time. The intent model provides guardrails, ensuring execution matches constraints and is auditable on-chain.

Shared fulfillment enables multiple users to submit compatible intents that are matched together. In this model, one user’s lending intent may match another user’s borrowing intent, creating decentralized peer-to-peer liquidity markets that don’t rely on pool-based intermediaries.

These emergent behaviors highlight the adaptability of intents as a foundational primitive. They are not limited to trading or investing—they can express any coordinated action that benefits from optimization, competition, and automation.

A new design pattern for decentralized interaction

The variety of use cases explored in this module reflects the flexibility of intents as a design pattern. Whether you’re a solo trader, an institutional fund, or a protocol builder, intents allow you to describe goals in human terms—and leave the execution to a programmable, trustless system.

This inversion of control, from user-driven transactions to outcome-driven intents, is what gives the model its power. It shifts responsibility for execution from the individual to a competitive marketplace of solvers, where the best strategies win. It also aligns incentives: users get better results, solvers get paid for performance, and protocols benefit from deeper engagement.