The Intent Execution Stack

Here, we break down how intent-based systems function behind the scenes. You’ll explore the role of solvers, the off-chain and on-chain flow of intent execution, and how validation, routing, and settlement work. The module shows how intents simplify user interaction and unlock new types of optimization and automation across chains.

From intention to outcome: bridging the gap

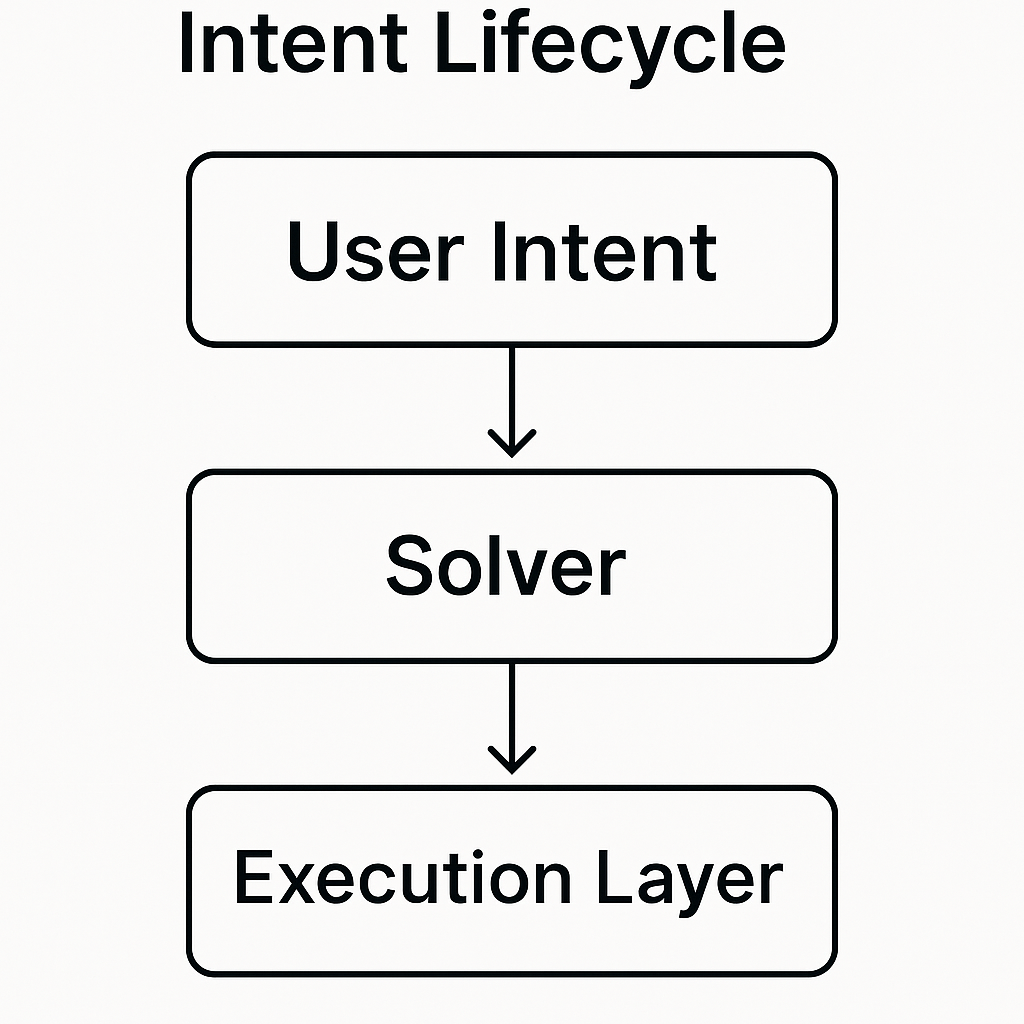

While intent-based DeFi begins with the idea of allowing users to declare what they want, the real innovation lies in how those intents are actually fulfilled. The journey from an abstract goal—such as “swap my ETH for USDC at the best rate”—to a successful blockchain transaction involves a carefully coordinated process. This process includes solvers, validators, smart contracts, and often multiple protocols across multiple chains. Understanding this execution pipeline is essential to appreciating the power and complexity of intent-based systems.

At the heart of this architecture lies a critical question: Who takes responsibility for converting a user’s intent into a working transaction? The answer is a new class of actors known as solvers. These entities act as intermediaries between the user’s declared intent and the blockchain’s execution layer. They are not just transaction relayers—they are optimizers, aggregators, and builders of strategies who compete to deliver the best possible outcome.

The role of solvers in intent execution

Solvers are responsible for interpreting an intent, determining the best way to fulfill it, and constructing a valid transaction that meets the user’s requirements. In many systems, multiple solvers may compete to fulfill the same intent, with the one offering the best result winning the right to execute.

This introduces a new layer of economic coordination into DeFi. Rather than users scanning DEX aggregators or manually comparing bridge routes, solvers do this work programmatically and in real time. They can analyze liquidity across multiple chains, evaluate pricing trends, account for fees and slippage, and even bundle multiple intents together to improve efficiency.

In some systems, solvers may also act as liquidity providers or interact directly with protocols to source execution routes. They are incentivized to act honestly because successful execution earns them a small reward, usually paid by the user or built into the slippage margin. Poor or malicious performance can result in penalties or exclusion from intent fulfillment networks.

As the ecosystem evolves, solvers are becoming increasingly sophisticated. Some are backed by professional trading firms and market makers; others are open-source bots run by community contributors. Their role is comparable to that of miners or validators in traditional blockchains—but rather than securing consensus, they secure execution quality.

How intents are expressed and discovered

Before solvers can fulfill intents, they need a way to find them. This introduces the need for an intent broadcasting layer—an infrastructure where users can publish their intents, either on-chain or off-chain, and solvers can monitor them.

Some protocols use off-chain relays, such as mempools or API endpoints, to collect intents. These systems allow users to keep intents private until fulfillment is confirmed, reducing the risk of MEV attacks or front-running. Others rely on on-chain registries, where intents are submitted as smart contract calls or stored in intent pools for public inspection.

The intent message itself is a structured data object that includes:

- The desired outcome (e.g., token swap, portfolio rebalance)

- Constraints (e.g., minimum received amount, expiration time)

- Preferred settlement chain or address

- Optional metadata for solvers (e.g., hints, fee settings)

These details help solvers evaluate feasibility and design optimal execution paths. Some systems also allow intents to include composable steps, such as “swap A for B, then stake B,” which encourages multi-step fulfillment by a single solver or a cooperating network of solvers.

Verification, settlement, and trust models

Once a solver picks up an intent and determines a path to fulfillment, the next challenge is verification. The intent must be validated against the user’s constraints, and the proposed execution must be provably correct. This often requires simulation, where the solver runs a local test of the transaction, or off-chain tools that verify output parameters.

If the simulation passes, the solver constructs the actual transaction and submits it to the blockchain. In some architectures, the solver also posts a bond or signature that proves it has fulfilled the user’s intent honestly. This verification mechanism ensures that only correct and beneficial outcomes are accepted by the protocol.

Settlement can occur in different ways depending on the system:

- Atomic settlement: The transaction either fully succeeds or reverts, protecting the user from partial execution.

- Asynchronous fulfillment: The intent is fulfilled over multiple blocks or time intervals, allowing more flexibility in complex or cross-chain scenarios.

- Bundled settlement: Multiple intents are combined and settled together, improving gas efficiency and creating room for solver arbitrage.

In all cases, the system must be trust-minimized. Solvers should not have custody over user assets, and the intent structure must prevent manipulation or partial delivery. Smart contracts play a key role here, acting as neutral arbiters that enforce execution rules.

Cross-chain execution and gas abstraction

One of the most powerful features of intent-based systems is their ability to operate across chains without user involvement in bridging or gas payments. Solvers can abstract away the complexity of moving assets between networks, allowing users to remain chain-agnostic.

In practice, this requires solvers to integrate with bridges, relayers, and liquidity networks that support fast cross-chain transfers. A user submitting an intent on Ethereum might have it fulfilled through a swap on Arbitrum, with the output bridged to Optimism – all without knowing or caring how it was done.

Gas fees are also abstracted. In many cases, the solver pays gas up front and recovers it from the outcome margin or via a service fee. This removes the need for users to hold native tokens on multiple chains, further reducing friction.

More advanced designs even allow users to pay gas in any token, or to include gas incentives in the intent message itself. This opens the door to meta-transactions, where users sign messages off-chain and solvers take care of everything else including gas.

Execution environments and solver ecosystems

As intent-based systems mature, a diverse ecosystem of execution environments is emerging. Some protocols run their own solver networks, while others allow open participation. In Uniswap X, for example, any solver can respond to a swap request with an offer, and the user selects the best quote. In CowSwap, solvers participate in sealed batch auctions where the best price wins without revealing execution strategies.

Flashbots’ upcoming SUAVE architecture takes this to the next level by introducing intent marketplaces, where intents are pooled and auctioned to validators or searchers who compete to fulfill them. This creates a new kind of intent economy, where solvers, validators, and protocols all participate in fulfilling user goals as efficiently as possible.

Some systems go even further by allowing intent composition, with solvers fulfilling multiple, interdependent intents at once, across users. This enables cooperative execution strategies, optimized liquidity usage, and novel forms of value flow that are simply not possible in transaction-first systems.

Execution quality, failure handling, and reputation

Despite the automation, fulfilling intents is not risk-free. Network congestion, volatile prices, or liquidity shifts can cause intents to fail or under-deliver. Protocols must therefore build in fallback systems, timeouts, or alternate solvers to recover from failed attempts.

Some systems introduce reputation mechanisms, where solvers earn trust over time based on execution accuracy and success rate. Poor performance can lead to exclusion or reduced access to premium intents. These models create economic alignment between solvers and users, much like validator slashing in proof-of-stake systems.

In addition, some protocols allow users to select preferred solvers or establish trust relationships with solver services. This creates a flexible trust model that blends permissionless access with performance-based filtering.

Why understanding the stack matters

The intent execution stack is not a black box. It’s a programmable, modular, and competitive marketplace that determines the quality of user outcomes in intent-based DeFi. Knowing how it works is critical for anyone building on or interacting with these systems.

For developers, it means designing intents that are secure, expressive, and fulfillable. For users, it means choosing front-ends and networks that offer reliable solver support. For protocols, it means building incentive systems that attract honest, high-performance solvers who improve the quality and efficiency of fulfillment.

Intents are only as powerful as the infrastructure that makes them real. The solver network, execution pipeline, gas abstraction tools, and settlement layers together form the engine room of this new paradigm.