What Are Intents in DeFi?

This module introduces the concept of intents—a new way of interacting with DeFi protocols where users define what outcome they want, not how to get there. It explains how this model solves key pain points like poor UX, failed transactions, and chain fragmentation. You'll learn why intent-based systems are gaining traction and how they shift focus from actions to goals.

Decentralized Finance and Intent-Based DeFi

Decentralized finance has achieved enormous technical growth since 2020, but its user experience remains unintuitive. Most users, even those familiar with Web3, still interact with DeFi by constructing manual transactions, like step-by-step instructions that must succeed exactly as written. If any condition changes, the transaction fails. This rigidity limits accessibility and efficiency, especially in a multi-chain world where liquidity is fragmented and bridges introduce complexity.

Intent-based DeFi challenges this model by shifting the paradigm. Instead of telling the blockchain how to perform a transaction, users simply declare what they want as an outcome – “an intent.” This intent is then picked up by third parties who compete to fulfill it using whatever tools and routes are most effective. As a result, the user no longer needs to decide how a transaction should be executed. The focus moves from the how to the what.

From transactions to intents: a structural shift

An intent is a high-level declaration of purpose. For example, “I want to swap 1 ETH for as much USDC as possible” is an intent. It doesn’t specify which chain to use, which DEX to trade on, or how to handle slippage. It simply expresses a goal. The responsibility of figuring out the best path is passed to solvers, who are automated agents or protocols that evaluate multiple routes and fulfill the intent in the most efficient way possible.

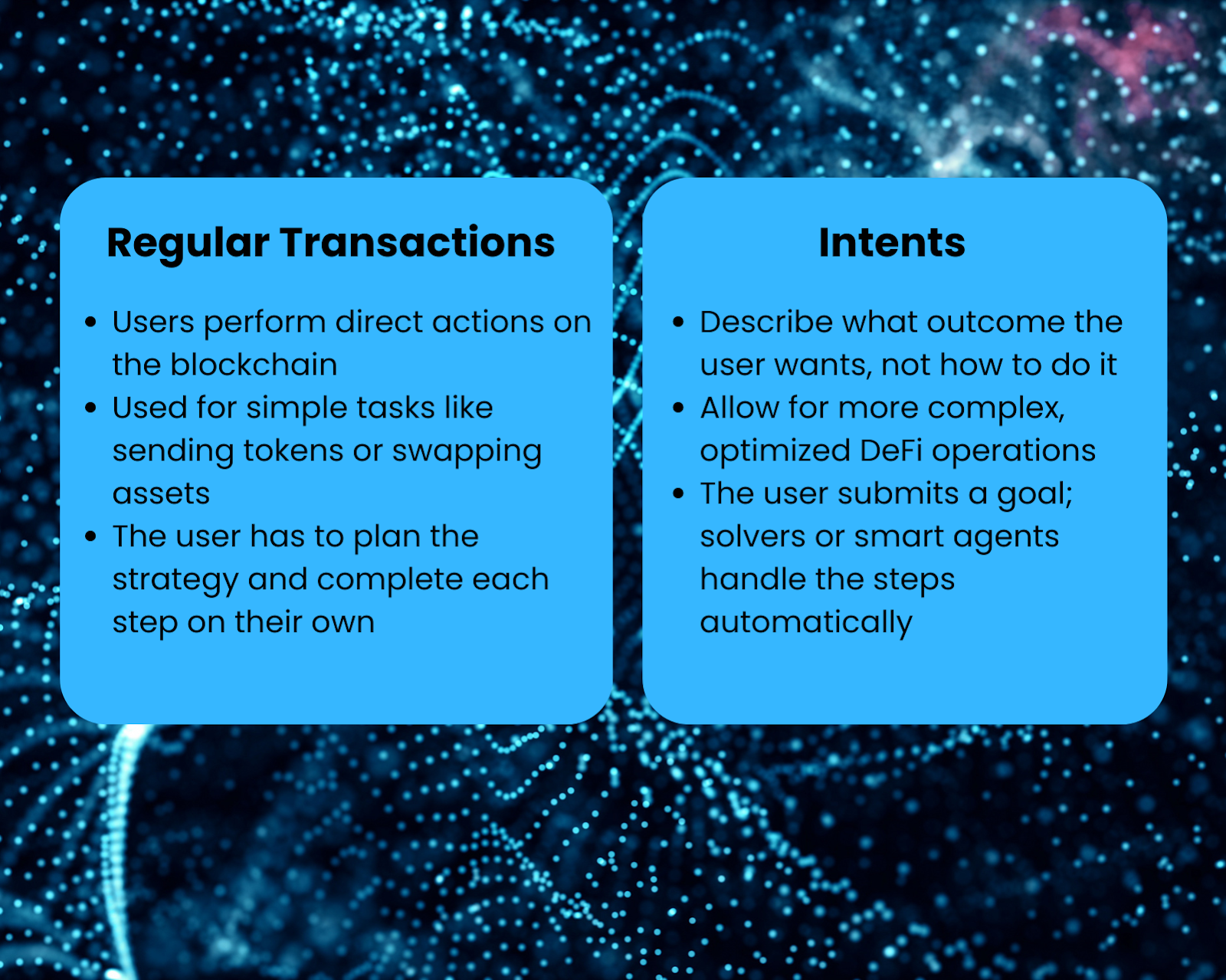

This introduces a key structural difference between intent-based systems and traditional transaction-based systems. Transactions are atomic, explicit, and manually constructed. Intents are flexible, abstract, and outcome-oriented. Rather than relying on users to string together smart contract interactions across chains, intents allow those decisions to be handled programmatically by third parties.

In practice, intents are often submitted off-chain or within dedicated intent layers. These messages describe the user’s objective and any constraints, such as deadlines or maximum slippage. Once broadcast, solvers listen for available intents and attempt to fulfill them competitively. This opens up new design possibilities for wallets, aggregators, and cross-chain infrastructure.

Why traditional DeFi is reaching its limits

The current DeFi stack depends heavily on synchronous execution. If a user wants to swap tokens, they must initiate the transaction, choose the execution path, and complete the interaction all in one go. This leaves little room for optimization. If gas fees spike or liquidity dries up in the middle of a transaction, the trade may fail or be executed at a poor rate.

Moreover, cross-chain DeFi requires users to interact with bridges manually, often through complex multi-step flows. The mental overhead of managing chains, wallets, and transactions is significant. For newcomers, this complexity is a major barrier to entry. Even experienced users are frequently frustrated by failed transactions, unexpected gas costs, and protocol-specific idiosyncrasies.

Intent-based systems aim to fix this by removing the burden from the user. When a user expresses an intent, they are stating a desired outcome and placing the logic of fulfillment in the hands of optimized, competitive solvers. These solvers can assess real-time liquidity conditions, compare execution routes, and fulfill intents asynchronously or atomically across multiple protocols and chains.

Intent-based logic in practice: the swap example

To better understand this approach, consider a simple swap. A user wants to exchange 1 ETH for USDC. In a transaction-based model, they must select the DEX (e.g., Uniswap), choose the path (ETH → USDC), approve token spending, and submit the transaction—hoping that nothing changes before it’s confirmed.

In an intent-based model, the user simply says, “I want to swap 1 ETH to USDC for the best available rate.” That’s it. The intent is broadcast. Solvers can then:

- Check all available chains for liquidity,

- Choose the most efficient DEX or bridge,

- Execute the transaction across chains if needed,

- Deliver the USDC back to the user on their preferred network.

This process eliminates the need for manual routing, bridging, or approvals across multiple platforms. It’s faster, safer, and much more user-friendly. More importantly, it reflects the way people actually think: in terms of goals, not execution steps.

Benefits of intent-based DeFi

The most immediate advantage of intents is improved user experience. Users don’t need to know what’s happening behind the scenes. They just state their goal and receive the result. This simplification opens up DeFi to a much wider audience, including those who find current systems intimidating or opaque.

Intents also create more efficient markets. Because solvers compete to fulfill intents, execution quality tends to improve. The best price, route, or path wins. This competitive layer introduces an optimization dynamic that’s missing in today’s rigid systems. Intents also allow for batching and bundling. Multiple actions like swapping, staking, and rebalancing can be wrapped into a single expression and executed together.

Another key benefit is composability. Intents can interact with multiple protocols across chains without the user needing to understand the technical boundaries between them. This creates the foundation for programmable finance that behaves more like a smart assistant than a static tool.

Finally, intents help reduce MEV exposure. Since intent fulfillment can happen through private negotiation or sealed-bid auctions, the risk of frontrunning is minimized. Solvers can build execution strategies off-chain and only submit transactions once everything is locked in, leaving no exploitable trace for MEV bots.

Real-world protocols using intents today

Several projects are already bringing intent-based architecture to life. CowSwap uses batch auctions to allow solvers to fulfill trades while minimizing slippage and MEV. Uniswap X takes it a step further by enabling off-chain RFQ fulfillment, allowing anyone to submit intents for token swaps and receive optimized execution from a global solver network.

Anoma is building an intent-centric protocol from the ground up. In their model, every value transfer begins as an intent. Solvers perform multi-party matching and settlement based on shared state. Anvil, on the other hand, focuses on creating a shared settlement layer for composable intents across multiple chains. Projects like Flashbots SUAVE are exploring auction-based fulfillment where intent bundles can be competitively executed with privacy and fairness guarantees.

What unites these systems is the move away from direct interaction with smart contracts toward a marketplace for outcomes. Intents are not a minor upgrade, they are a new mental model for how DeFi can operate.

For end users, this shift means simpler interfaces and less friction. Wallets can evolve from transaction signers to intent broadcasters. Front-ends no longer need to expose routing details, gas estimation, or manual bridging. Users get a smoother experience, and developers gain the freedom to design around goals, not protocol constraints.

For builders, intents introduce new challenges and opportunities. Solvers must be reliable, performant, and economically rational. Protocols need to support flexible execution paths and state reconciliation. But those who adapt early will benefit from a more composable, scalable, and user-centric financial stack.